Welcome to the Glossy+ Research Briefing, your weekly curation of fashion and beauty research insights. Glossy+ members have full access to the research below.

In this edition, we share focal points from Glossy’s recently released report about how marketers’ social platform budgets stack up.

Interested in sharing your perspectives on the future of fashion, luxury and beauty?

Apply to join the Glossy research panel.

CMO Strategies: Marketer confidence in Instagram increases from 38% in Q3 2022 to 46% in Q1 2023

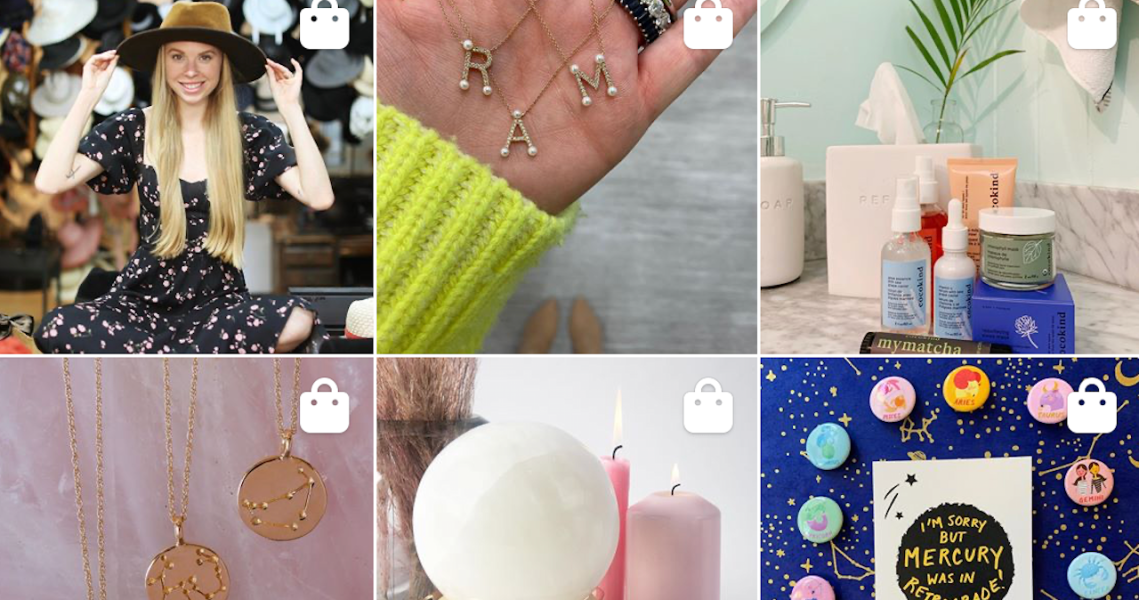

Instagram, Facebook, TikTok and YouTube took the top spots for marketers’ budget spend in 2023, according to Glossy+ Research’s recent analysis of budget allocations across social media platforms. TikTok, which came in third, has risen to the top of many marketers’ minds because of its ability to create viral moments for brands. However, not all respondents to Glossy’s survey felt positive about TikTok’s potential. When asked about their confidence in TikTok as a successful marketing platform, brand respondents were less optimistic compared to when they were asked about Instagram.

Ad position: web_incontent_pos1

Key findings:

- The percentage of respondents who said they were somewhat confident, confident or very confident in TikTok fell slightly between Q3 2022 and Q1 2023, from about 56% to 52%. The slight decrease can point to challenges with the platform as a marketing tool, such as unpredictability about what goes viral on TikTok and a potential ban in the U.S.

- Instagram saw an increase in marketer confidence within the same time period, from about 38% to 46%. Compared to platforms like TikTok and Reddit, which can pose brand safety risks through a lack of control over where marketing content appears, and specialized platforms like YouTube, which are limited to serving video content, Instagram continues to provide a wide range of tools for marketers and a consistent user base.

Research Rewind: Only 18% of luxury shoppers use TikTok once a week

Ad position: web_incontent_pos2

Considering social platforms from a consumer perspective, TikTok has the least penetration among older generations of luxury shoppers, according to an April 2023 Glossy and Saks survey of 3,944 luxury consumers on their current shopping habits. Only 18% of respondents said they use TikTok once a week. This was the same percentage as those using Pinterest, and a slightly lower portion than those on Twitter (20%). Out of the survey respondents, 77% were above the age of 41.

TikTok, of course, is wildly influential on other consumer age groups because of its ability to create viral brand moments. A local Alabama retailer went viral in 2021 when University of Alabama sorority hopefuls began sharing outfit-of-the-day posts on TikTok under the hashtag #BamaRush. Public fascination with the womens’ fashion posts even spawned a “Bama Rush” documentary, which premiered on Max in May.

Key findings:

- For the typical Saks luxury shopper, Meta platforms dominate their social media activity. Instagram is the top social platform of choice with 65% of respondents saying they use it at least once a week, while Facebook came next at 54%.

- When it comes to online shopping, free shipping is an absolute must: Eighty-three percent of respondents said they are unlikely to buy from a retailer that does not offer it. The second most important factor for them was a loyalty program, with 32% saying they’re unlikely to shop from a company without one.

See research from all Digiday Media Brands: