Glossy is running a series of stories on how the fashion and beauty industries are preparing for a potential recession. We’re digging into how companies plan to manufacture, fundraise and run a retail fleet when the economy suffers.

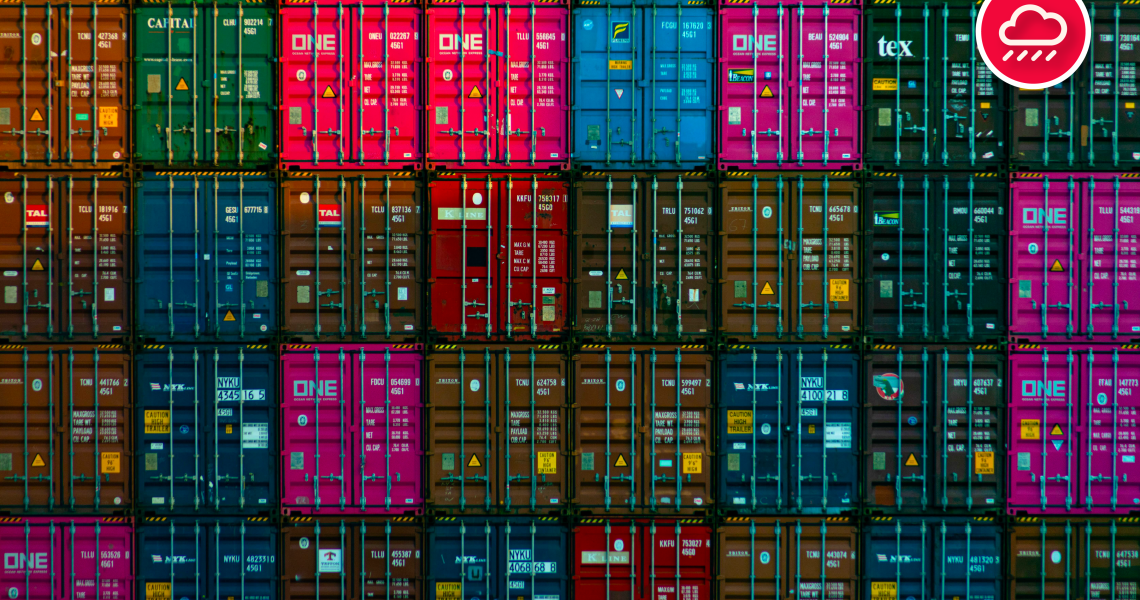

Although the brewing recession’s full impact on fashion’s supply chain is unconfirmed, companies are preparing for new challenges when it comes to shipping.

Early indicators show that the freight market has not yet been affected by recession news, but the importance of staying flexible in light of changing conditions remains a priority. Supply chain goods transportation via shipping or ground is heavily dependent on different parts of the supply chain working in sequence. When one of these halts, businesses need to look to other solutions like air freight to mitigate the time lost during the halt.

Maria Borromeo, founder and CEO of DTC apparel brand ClHu, said that, given all of the delays that are happening on a global scale, it’s nearly impossible for a brand to plan far enough ahead to have its inventory ship from overseas, meaning they have to resort to shipping by air.

“This is exorbitantly expensive, especially for a small brand,” said Borromeo. “Right now, it’s something we’re choosing to absorb. It’s not something we can pass off to the customer. Our production run is too small at this stage. It would swing our costs too greatly, and we’d be priced out of our market.”

Some of the other interruptions are at the consumer end, where retailers are building back mass inventory levels in spite of a lack of consumer interest. Imports in April remained at near record-high volumes, according to the tracking a report by the National Retail Federation and Hackett Associates. However, with more disruptions across the supply chain, including in the last mile where customers expect speed and convenience, brands may not be able to keep up.

As this knock-on effect begins to take shape over the next few months, retailers could be looking at inventory stuck in containers on ships, and costs for keeping the containers in the ports piling up. Rising fuel prices are also making for more expensive shipping. According to the New York Times, the cost to ship a container from China to the West Coast of the U.S. is 12-times more expensive than it was two years ago. The average commercial semi-truck is now paying $2 more than a year ago for the 6.5 miles it travels per gallon of gas.

Ad position: web_incontent_pos1

David Food, head of supply chain at business decision-making platform Board International, said the uncertainty in the market is leading to a number of effects in shipping.

“The current shipping market is reasonably problematic, as costs have become very unpredictable and routes have become congested and overloaded,” he said. “Particularly, this has been seen going into the U.S. and China, as a result of unloading capacity. But it’s further exacerbated by the lack of visibility and delays causing unpredictable knock-on effects, with port systems creaking under strain.”

The current environment is forcing businesses to be nimble and react to the growing number of shipping challenges. However, Food said that the consumer goods market looking for alternatives to current routes creates a tighter market. Prices will become more unpredictable and capacity forecasts unreliable.

“The current challenges in shipping are being able to maintain a profitable ship rate with confidence to attract more stable and longer-term contracts,” Food said. “Everything is very short-term at present.”

However, there are solutions that businesses can implement to re-design their existing supply chain routes and strategies. These include reconfiguring their supply chain to focus more on near- and right shoring. As opposed to nearshoring, which is increasingly difficult in areas where production is not yet happening, right shoring is focused on placing business components in countries that offer the right combination of output quality and cost. While this is not an optimal solution, as the variations between country price standards mean that, at times, priorities like ESG are left by the wayside, this solution offers a temporary fix to businesses struggling with their supply chain management.

Ad position: web_incontent_pos2

Brands like CIHu are planning in other ways.

“In normal times, we would plan far enough ahead in our development cycle to accommodate vessel shipping, but because everything is so volatile, you run the risk of not receiving your goods in time and not having inventory to sell,” said Borromeo.

The brand is also sourcing more local U.S. factories to work with that are willing to handle smaller production runs.

“Going forward, product development cycles will have to be extended to accommodate several months of vessel time,” said Borromeo. “There are negative implications to planning this way, as you’re not making real-time, data-based decisions on product development, which can lead to inventory overages as you’re not hitting the mark with what the customer wants.”

As the data on cross-industry shipping and freight is coming in, companies can work together as like-minded partners to accrue and analyze data to better understand the changing landscape and improve the taxonomy of risk discussion. This will overall create a more prepared fashion industry. This also extends to suppliers, which may be able to better plan ahead if they are more aware of how the market is changing and how brands are responding, as a result.

“It’s important to assess risk across the supply chain, paying particular attention to bottleneck and pinch points. [It’s also important] to increase plan granularity and extend planned visibility to first-tier suppliers to ensure more intelligent decisions,” said Food. The focus should also be on dual-sourcing across multiple suppliers, he said, and understanding which materials the brand uses most to prioritize their supply for the brand.