Men’s grooming was already a buzzy category before coronavirus, and stay-at-home orders are pushing men to adopt full-fledged routines rather than use just single products.

According to Spate data, searches for beard and mustache care products increased by 40% and 15%, respectively, for the week of April 24, compared to the week of February 9. This represents a 6% and 54% growth year-over-year for these categories. Specific men’s brands have also seen significant month-over-month search growth, with 7-year-old Mountaineer Brand experiencing a 1,000% increase between March and April, driven by its beard products, and The Art of Shaving experiencing a 51% increase between March and April. The adoption of full-fledged grooming routines for skin and facial hair via kits and bundles shows the granular ways in which coronavirus is accelerating trends and changing the daily habits of consumers and their priorities.

Scotch Porter’s customers traditionally purchase an average of two products at a time, which range from $11.99 to $19.99 each, but the brand experienced an undisclosed sales increase in product bundles. The two most popular kits were Superior Collection kits, one focused on hair and the other on beard care. Both feature five products, with the hair version retailing for $51.99 and beard for $71.99. Scotch Porter’s e-commerce sales have increased 104% between mid-March and May, compared to the same period last year, while new customers increased by 34% during the same time, said Calvin Quallis, Scotch Porter founder.

Subscription-only skin-care kit brand Tiege Hanley experienced an 8% increase in new subscribers between March and April, compared to January and February, said Kelley Thorton, Tiege Hanley founder and CEO. Meanwhile, premium grooming brand Fulton & Roark experienced a 128% increase in sales of bundles and kits in April compared to February, with the top seller being the Ultimate Intro Kit, which has three products (a combo shampoo-conditioner-body wash, face wash and moisturizer) and is priced at $99. Growing a “quarantine beard” has reportedly become a hobby, which is likely inspiring men to purchase products for taking care of them. Meanwhile, companies like P&G and Unilever have mentioned that shaving cream and razor sales have slipped.

Many theories abound on why men have taken up increased interest in full-fledged routines, ranging from being more hygiene conscious to looking for ways to improve themselves physically when unable to work out at a gym.

“We don’t normally push kits and bundles outside of the holidays, but we started to see this organic increase [in sales], and it was too early to be for Father’s Day or graduation,” said Kevin Keller, Fulton & Roark co-founder. “My guess is it’s another way to optimize. For guys who don’t live alone, they may find the shower as a moment of solitude and want to improve that experience.”

Fulton & Roark’s social media marketing and communications have shifted from focusing on ingredients to self-care and how men can try to make the most of their quiet moments. Its core customers are between ages 30-45, with a household income of $100,000 or more. The brand has been including kits and bundles in all its email marketing since late-April, sending up to three every week to 70,000 subscribers, which has been a key driver of sales, said Keller. Fulton & Roark has social advertisements running across Facebook and Instagram for its solid fragrances but has not advertised its bundles and kits on the platforms.

Ad position: web_incontent_pos1

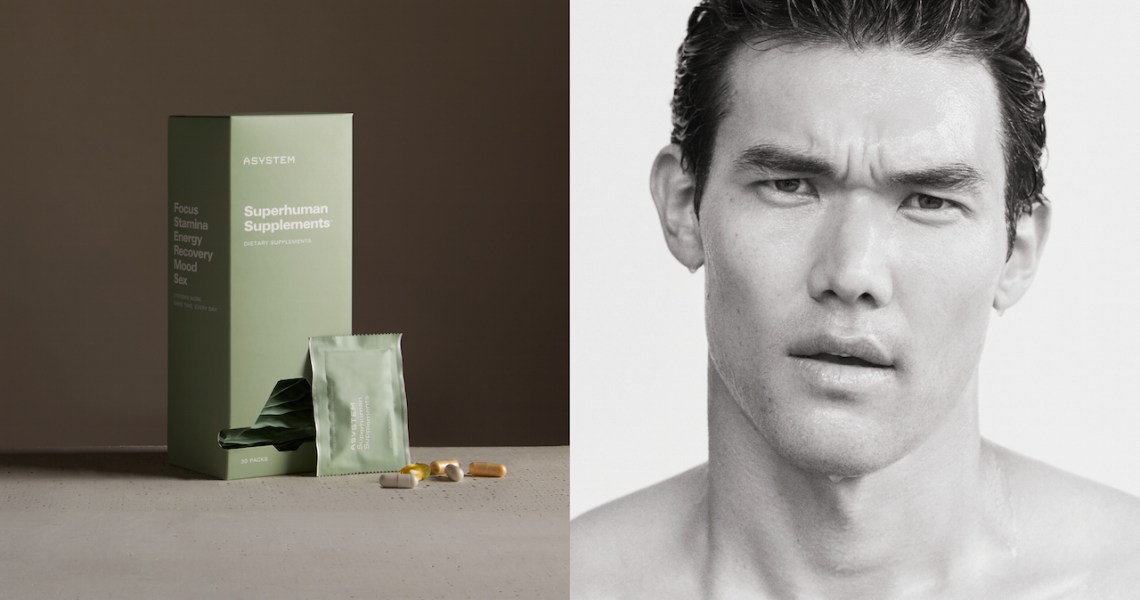

Meanwhile, Asystem, a men’s ingestibles and skin-care brand saw March making up 50% of the brand’s first-quarter growth, which overall was 100% compared to the fourth quarter. The two products that have seen the biggest increase are its Superhuman Supplements and the Performance Skincare Kit, the latter of which includes a 30-day supply of cleanser, SPF moisturizer and night cream. Those two products outpaced sales expectations by 25%.

Oli Walsh and Josh LeVine, Asystem co-founders, attribute this to heightened customer interest in self-care and sanctuary while quarantining. The brand offers subscription and individual purchases, and over 66% of customers are subscribers. Subscription retention has increased between March and May. Since April, Asystem has been regularly advertising both the Superhuman Supplements and Performance Skincare Kit across Facebook and Instagram.

“This shows a reprioritization around customers’ wants and needs and what’s important,” said LeVine, pointing out that people are apt to buy less clothing and engage in extracurricular activities, but are trying to find other ways to look and feel good.