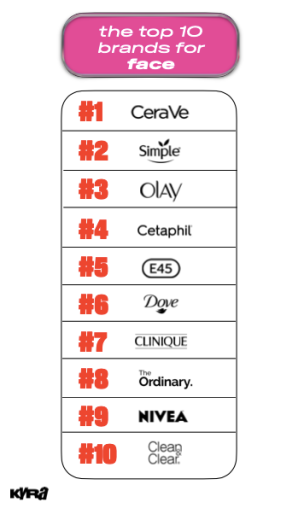

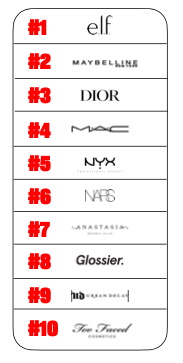

With TikTok and accessible price points on their side, E.l.f. Cosmetics and CeraVe are the top makeup and skin-care brands for Gen Z, according to the results of a new report by Gen-Z media company Kyra.

Kyra‘s “2022 Gen Z State of Beauty Report,” a survey of 1,000 participants between the ages of 18 and 25, found that E.l.f. Cosmetics ranks as the top makeup brand that respondents use daily, bumping Maybelline from first place last year into second place in 2022. For skin care, CeraVe came out on top, indicating the continued success of accessible beauty brands that have achieved viral status on TikTok.

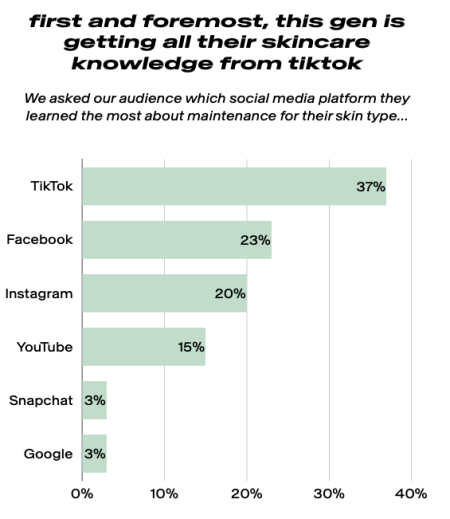

“There’s a direct relationship” between which brands have gone viral on TikTok and which ones are ranked most highly with Gen Z, said Marina Mansour, vp of beauty and wellness at Kyra.

TikTok was the No. 1 source of skin-care information for respondents as Gen Z “skintellectuals” actively research ingredients and focus on preventative anti-aging products at an earlier age than their millennial predecessors did. CeraVe has especially benefited from this wave after leaning into its popularity with top TikTok skinfluencers such as Hyram Yarbro, keeping its momentum going beyond viral moments.

While acne is still the top skin concern for Gen Z, they’re increasingly getting into anti-aging as a preventative measure. While the No. 1 most-used product among Gen Z is a moisturizer, SPF came in second, followed by face masks in third. Anti-aging hyaluronic acid jumped from eighth place in 2021 to fourth this year.

Ad position: web_incontent_pos1

“The appetite for purchase is super high, but to get to that purchase, they need to see the before and after, and how it works in a routine,” said Mansour.

The popularity of brands famous on TikTok extends to makeup, where TikTok success story E.l.f. Cosmetics came out on top on this year’s list. Last year’s first-place brand, Maybelline, came in second after experiencing its own TikTok successes over the past two years. Its Sky High mascara that went viral on TikTok in January 2021 still frequently sells out on Amazon.

“E.l.f. has been fearless with their approach to TikTok,” said Mansour. “They have been really bullish on the platform, and that’s reflected.”

Ad position: web_incontent_pos2

Gen Z’s makeup favorites extend beyond drugstore brands when it comes to products they’ve found on TikTok: Dior Beauty jumped into third place this year after seeing several products spark a frenzy on the app, including its Rosy Glow blush in 2021 and Addict Lip Oil that went viral this year.

Dior’s success is “encouraging,” showing that a beauty product’s virality on TikTok can drive sales “irrespective of the price point,” said Mansour.

Gen Z is eager to experiment with new products they learn about: Forty percent said they buy at least one new product they discovered online every two months.

The report also looked at trends in hair care, body care and fragrance among Gen Z. For both hair and body, drugstore brands reign supreme: Tresemmé tops hair-care brands for respondents, while Dove ranks No. 1 for body.

When it comes to fragrance, Gen Z shoppers are still discovering what they like, with only 21% wearing a fragrance every. But they are learning quickly, as 60% own between three and five fragrances. The gender-neutral fragrance boom is resonating with Gen Z, as 43% are interested in wearing a genderless scent. Aesthetics also matter, sometimes even more than the scent itself: More than half of respondents said that the bottle’s look is important to their purchase decision, while slightly less than half said the same for smelling the fragrance in real life.

With the rise of gender-neutral products, the report describes Gen Z as “gender-agnostic”: Sixty-nine percent said they see beauty creators of all genders as equally influential to their purchase habits.

To resonate with Gen Z, the report’s advice is to engage with content creators, especially those of the TikTok variety. For beauty creator content, respondents said they’re most interested in tutorials, with 17% listing them as the type of content they want to see more from.

With the dominance of humor on TikTok, beauty content also can’t take itself too seriously: Sixteen percent want more funny content. “Humor” was listed as the second most important trait respondents expect from beauty creators, following “honesty” and tied with “relatability.”