Ushopal, a China-based brand accelerator for niche luxury beauty brands, announced on Mar. 8 the completion of a $100 million round of financing to support its portfolio expansion in China and the Asia Pacific.

Founded in 2017 in Shanghai, Ushopal has 13 brands in its portfolio, including Spanish skin-care brand Natura Bissé and French perfume brand Juliette Has a Gun. In 2020, its gross merchandise volume (GMV) reached over $200 million. Its rapid growth in the last four years signifies the growing importance of the Chinese market for Western premium beauty brands eager to establish a way in.

“After Covid-19, everyone has seen the rising potential of Chinese consumers,” said Regina Zeng, venture manager at Plug and Play China, with clients including L’Oreal China. “The high-end beauty market here is still predominated by foreign brands, so new brands will continue to have space to grow upon entering the market.”

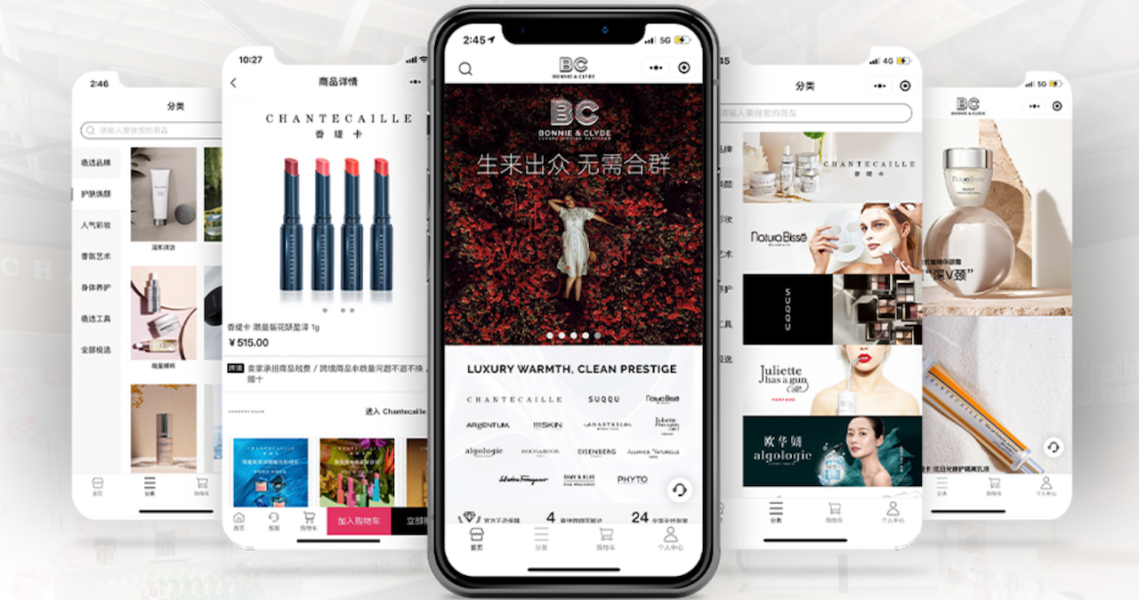

To help brands build an omnichannel presence, Ushopal has a network of more than 2,500 luxury influencers, an in-house content studio, a branding team, an omnichannel growth team, global logistics operations and brick-and-mortar stores under the name Bonnie & Clyde. According to William Lau, Ushopal’s partner and vp and Bonnie & Clyde’s CEO, building an omnichannel presence isn’t about “blasting into the market, but [rather] very deep-diving into each specific community” to drive its members to either online or offline stores.

For Juliette Has a Gun, known for using the analogy of perfume as a weapon of seduction in its marketing, Ushopal has worked closely with the LGBT community to amplify timely discussions around relationships and sex. The team has also tapped into China’s artistic community, which includes beauty photographers, street photographers, tattoo artists and bartenders. It was ranked in the top-three-selling brands in Tmall’s niche perfume category in each of the last 10 months.

“We want to establish a very strong bond within each of these community groups,” Lau said. For example, the tattoo artist could do a painting on the perfume bottle and share it on Bilibili. For us, that’s a way to create a very strong content bond with the consumers.”

Cross-category content production is one of the main drivers in engaging with untapped communities who may be the brand’s future customers. When Lau reached out to a Chinese food blogger to promote a perfume called ‘Mmmm…,’ she was surprised as she had never worked with any beauty brand. “The concept [of the perfume] is that you’re so sweet, I want to eat you. So I said to her: ‘This particular perfume has a raspberry top note, a vanilla heart note and the sandalwood bottom note. Use your imagination and create the dessert you want,” he said.

Ad position: web_incontent_pos1

The blogger created a raspberry vanilla tart and shared her inspiration — the perfume from Juliette Has a Gun — with her followers on WeChat. The post ended up selling RMB 400,000 (around $61,450) worth of products ($135 for 100ml in the U.S.) through a link directed to Bonnie & Clyde’s WeChat store.

Once an order is placed on Bonnie & Clyde, customers within Shanghai can receive their order in under four hours, and others in China will receive it in under 24 hours. In addition to the online store, Bonnie & Clyde has five physical stores, including in Jing’an Kerry Center and Plaza 66 in Shanghai. With the new funding, Ushopal plans to expand the chain store to more metropolitan areas, including Beijing and Chengdu, with a goal of having 11 destinations by the end of 2021.

The niche luxury brands Ushopal brings on-board, despite being unfamiliar to the Chinese audience, may benefit from a compound effect when presented together. “Many multi-brand stores carry brands that have [certain] characteristics and that fit [Ushopal’s] portfolio, and they also attract consumers of this category,” Zeng of Plug and Play China said. “So the stores come with channels and traffic, which provide great growth or incubation value for new brands in the market.”

While retailers all over the world don’t deny the importance of omnichannel, Lau said it’s especially so in an ever-changing market like China. “Today, the channels for content are much more segregated, and the way consumers buy is much more segregated,” he said. “One of our key differentiators is that we’re able to manage the entire ecosystem.”