When Coefficient Capital raised its first fund of $170 million in March, the idea was to invest in consumer brands that could weather a recession. Fast-forward nine months later, and Coefficient Capital managing partner Franklin Isacson, who previously worked as a brand manager at LVMH and opened the U.S. office for European-based Verlinvest, said the early-stage firm has already made big bets on disruptive consumer trends.

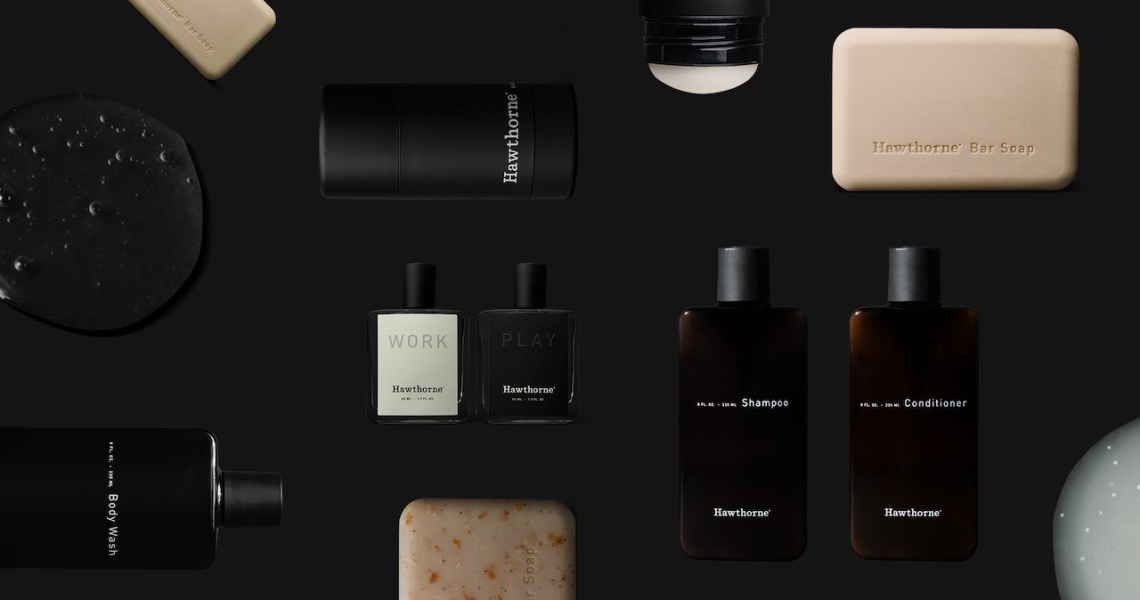

For example, Isacson said Coefficient has invested in Hawthorne, a digitally-native men’s grooming brand, adding to its portfolio that includes wellness ingestibles brand Hydrant and other food products like oat milk and apéritifs. Hawthorne has not formally announced the funding, but Isacson joined its board in March, according to his LinkedIn.

Isacson spoke with Glossy about what drove the recent Hawthorne investment, how Covid-19 will impact 2021 investing and what future customer habits can be gleaned by looking back at the 2008 financial crisis.

Has Covid-19 impacted your investment strategy?

We were always focused on brands that have the ability to sell omnichannel and not just rely on DTC. And our conviction has been strengthened since a lot of the consumer trends that we have invested in have accelerated through the pandemic. We’ve closed on four new deals [during] the pandemic and all are fast-growing omnichannel CPG brands: Premium men’s skin-care brand Hawthorne, the Oatly oat milk business, Magic Spoon, which is a low-carb high-protein cereal brand, and then the Haus spirits brand.

Gross margins were always very important, and profitability was always important. But, we focus more on liquidity than we did before because it’s hard to know what the world will look like a year from now.

What was behind the interest in Hawthorne?

There are three things that attracted us to Hawthorne. One is that men’s grooming has been called “the next big thing,” but it hasn’t really ever taken off until now. The Hawthorne positioning is interesting because it’s definitely a trade-up, compared to the supermarket and drugstore brands, but it’s not so fancy that it’s only something that your partner would buy for you for the holidays. What was is that the brand started out selling cologne online, which, as you imagine, is very hard to self-promote. They use their customization engine to predict what smells you might like for cologne, and they use that for other personal care categories like body wash, deodorant, shampoo and face wash. That’s become particularly relevant in the last couple of months when people are unable or unwilling to go into stores and test products.

What are your expectations for early-stage investing in 2021?

I’m an optimist. One of the things that we saw in 2008-2009 and even after 9/11 was this creative destruction that takes place. It leads the way and provides new opportunities for new brands to emerge. As our routines have changed — we’re no longer just going to the same drugstore to buy the same products — we are willing to consider all these new brands. There is a great opportunity for emerging brands, simply because of the way we shop has fundamentally changed.

Ad position: web_incontent_pos1

But we’ll also be heading into a tough economic year. We can look at the data from 2008 and 2009 to see what categories consumers trade down in. We think about it through that lens, as well, [to see] which categories are most vulnerable in economically harder times.

What are some of the fundamental shifts in the beauty industry as a result of Covid-19?

One of the things that have changed is the willingness to buy products online, without having to try them in-store. That’s something consumers say they’re totally fine with. Brands have done a much better job at talking about product functionality and bringing people into their brands, whether it’s [through] social media or editorial content or through their website — especially those brands that offer customization and product-finder quizzes.