With the holiday shopping season in full swing, brands and retailers across beauty and fashion are trying to find their bearings and emotionally prepare themselves for uncertain outcomes.

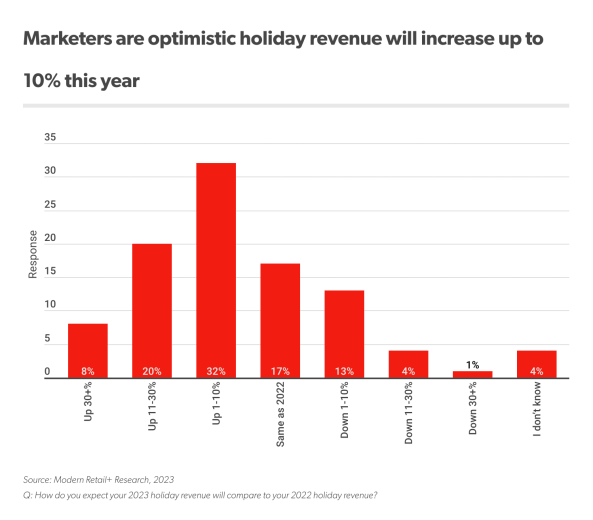

According to a Glossy+ Research survey of 118 marketers, most survey respondents (61%) told Glossy that they expect 2023 holiday revenue to increase this year, and 17% said they expect it to remain about the same as last year. Another 13% held a pessimistic view, expecting holiday sales to decline between 1-10%.

For its part, the National Retail Federated found that a record 200.4 million consumers shopped over the five-day holiday weekend from Thanksgiving Day through Cyber Monday, surpassing last year’s record of 196.7 million. NRF’s initial expectation was 182 million shoppers. Yet, despite the number of people shopping, spending only increased 2.5% year-over-year (not adjusted for inflation), according to Mastercard.

NRF data found that the majority (95%) of Thanksgiving weekend shoppers made holiday-related purchases during the annual shopping event, a decline from 97% last year but in line with historical levels. Consumers spent $321.41 on average on these types of items, consistent with $325.44 last year. However, compared to 2022 Black Friday sales data, higher-priced items, like electronics, were less popular purchases. Instead, personal care and beauty items leaped into popularity in 2023, with 23% of gift shoppers making a purchase.

The global economy has been disjointed from consumers’ perceptions and behavior throughout 2023. By all major economic indicators, the U.S. economy is healthy. In an October report from the U.S. treasury, the GDP has risen above pre-pandemic levels, currently sitting at 6.1% higher than in the fourth quarter of 2019. The current unemployment rate is 3.9%, according to November Bureau of Labor Statistics data, and has been consistently below 4% since January 2022. Compare this to other G7 countries, including France, Italy and Canada, and only Japan and Germany’s unemployment rates were lower than the U.S. And inflation, a hot topic throughout 2022 and 2023, has declined significantly over the past 12 months.

Yet, consumers do not share this positive or even cautiously optimistic outlook for the U.S. economy. In November, around the time of Black Friday, consumer confidence dropped for the fourth straight month, according to the University of Michigan. Additionally, consumer expectations for inflation in 2024 rose to 4.5%, which is twice the Federal Reserve’s 2% target. More than half of consumers (56%) said inflation has impacted their holiday shopping plans this year, according to a Q3 consumer trends report from Jungle Scout, an Amazon seller software platform for data and inventory management. Those consumers’ top strategies to reduce 2023 holiday costs include spending less per person on gifts, buying things on sale and cutting back on decorations, according to the report.

Ad position: web_incontent_pos1

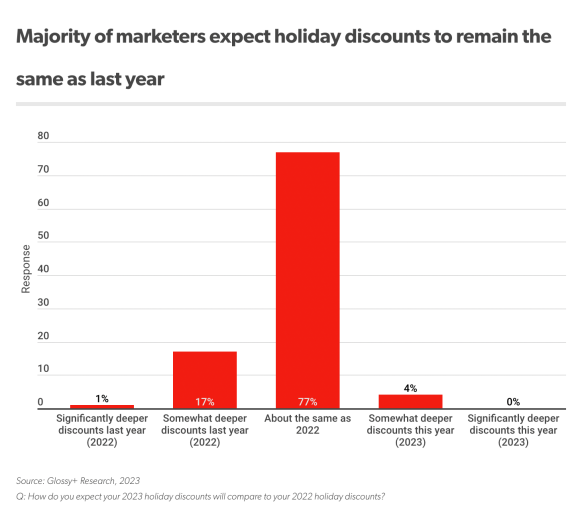

With that in mind, holiday discounts were anticipated to remain the same compared to last year, per Glossy’s research. About 77% of survey respondents said discounts would remain the same as in 2022, while 4% expected “somewhat deeper discounts” in 2023. According to Boston Consulting Group, consumers universally said that their preferred brand deal was a clear discount on all items, as opposed to a steep discount on select items, free or reduced shipping, or bundle deals. When asked about the minimum discount qualifying for a “good deal,” consumers said they expect at least 30% off.

WalletHub surveyed over 3,500 deals from 13 of the biggest U.S. retailers’ 2023 Black Friday ad scans, finding that apparel and accessories had an average of a 42% discount, with JCPenney topping the list with a 58% discount average. In addition to discounts, JCPenney used giveaways, video ads, a social media “Penney Prepper” challenge and paid creator partnerships, among other strategies, to promote Black Friday shopping. The retailer made working families and making dollars stretch further a focus for advertising, including in its “Make Your Holidays Count” video ads. The average discount for consumer-packaged goods was 27.5%, with Macy’s offering the highest discount at 45%. According to the company’s third-quarter earnings call from November, Macy’s holiday strategy focuses on evolving its “Give Love. Give Style” holiday campaign introduced last year. It features clearer customer-facing language to drive authority, discovery and conversion, according to the earnings transcript. Additionally, during the holiday shopping event, there was 26% “less aged inventory” this year across Macy’s, Bloomingdale’s and Bluemercury.

Surprisingly, some brands have bypassed the Black Friday discount craze. Jones Road has not held a Black Friday sale throughout its 3-year history, yet it managed to more than double its Black Friday sales using a mix of limited-edition kits of its hero product, Miracle Balm. Non-Black Friday participation has gained attraction over the last few years across beauty and fashion, but typically as a statement against rampant materialism. Patagonia has eschewed Black Friday sales since 2016, while Allbirds actually increased its products’ prices by $1 on the shopping holiday in 2020. The additional money went toward Greta Thunberg’s international climate movement Fridays for Future. Deciem has offered a 23% discount throughout November instead of a Black Friday-specific offer since 2019. Lush does not have Black Friday sales but, this year, it’s offering a limited-edition bath bomb with sales going to its “Big Tech Rebellion” campaign.