In this week’s briefing, an in-depth look at the making of a modern brand empire. To stay up-to-date on the latest runway shows, digital presentations and behind-the-scenes buzz, sign up to receive Glossy’s daily Fashion Month Briefing (September 9-October 4).

Matt Scanlan wants to build “the next LVMH, in the U.S.,” he said on a call earlier this summer.

It’s not the first time the head of an American fashion company has vocalized the goal of growing it to such an industry-dominating status. But it also didn’t cue an eye-roll, based on Scanlan’s explanation of what he’s building and how he’s building it, as well as his track record.

Little-known Naadam Collective kicked off in 2019 with an acquisition of fashion darling-turned-DTC brand Thakoon. It’s now made up of six brands, with a seventh in the contractual phase and set to close by the end of September. This year, the group is on schedule to reach profitability and bring in “hundreds of millions” in revenue. Within five years, the plan is to acquire 5-10 more brands and reach the $1 billion mark, with each brand scaling to drive, on average, $75 million-$150 million per year. Outliers like Naadam and Something Navy, the portfolio brand founded by fashion influencer Arielle Charnas, could reach $300 million-$400 million, Scanlan said.

In early September, Naadam Collective expects to close an in-swing funding round of $75 million, intended for brand acquisitions. An investor draw, according to Scanlan: A single brand is more vulnerable to wild market shifts, while a group with sound financials is a safer bet. In the face of the unknown that lies ahead, the resounding advice for founders and investors alike remains to move conservatively.

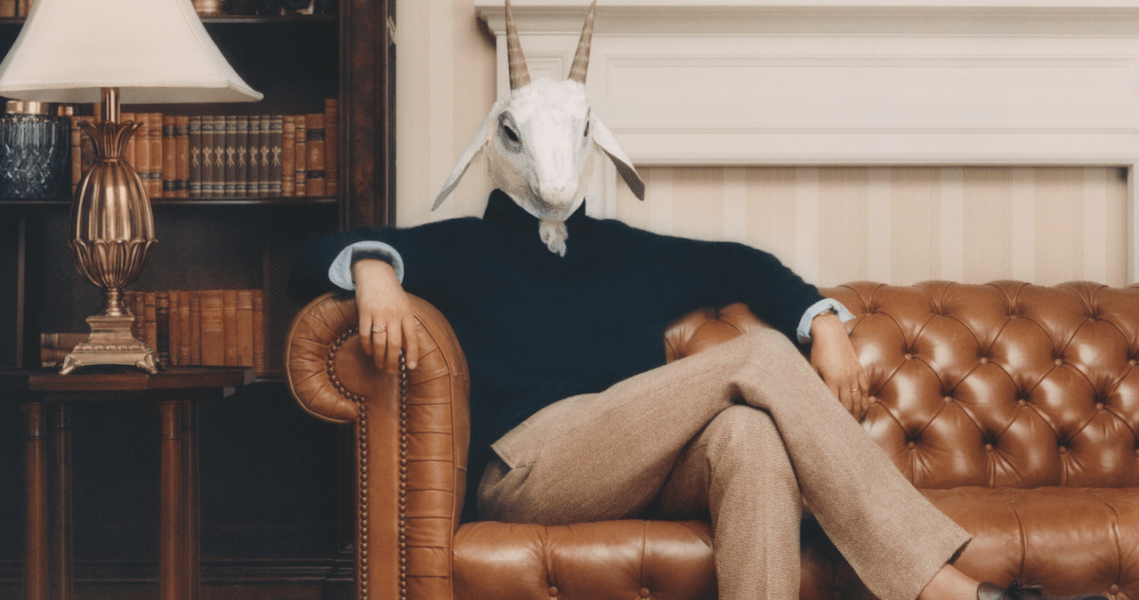

Among the founders that put the direct-to-consumer model on the map, Scanlan and college friend Diederik Rijsemus launched the cashmere apparel brand Naadam in 2013, fueling the company with the common DTC tools of market-comparable affordability, digital marketing and a compelling founder’s story. Naadam’s story centered on the founders befriending local goat herders while on a trip to the Mongolian Gobi Desert. In 2017, the brand’s first pop-up, in NYC’s SoHo, was designed to mimic a Mongolian yurt, or tent. In subsequent years, Naadam managed to stand out in the landscape as it crowded, thanks, in part, to a dedication to marketing campaigns with shock value. In 2018, wild postings featuring goats having sex were used to drive NYC pedestrians to the brand’s first permanent storefront.

According to Shad Azimi, founder and managing partner of private equity firm Vanterra Capital, the success that Naadam and Scanlan have seen was built from the ground up. Vanterra was the first institutional investor in the Naadam brand; to date, it’s led four rounds of investment in the company, totaling two-thirds of its raised capital. Azimi sits on Naadam’s board. He recalled first meeting Scanlan at a non-air-conditioned sixth-floor walkup that was serving as his office. “He was surrounded by boxes of cashmere,” Azimi said. He decided to invest in Naadam, in part, due to Scanlan’s rare combination of being “very good at the vision, but also very good at the tactical mechanics of running a business.” In addition, he had a good team surrounding him, including Rijsemus.

Ad position: web_incontent_pos1

“I don’t normally sit on boards as early stage as this company was,” Azimi said. But he saw the potential for the company to grow beyond the common DTC brand revenue cap of $20 million to $30 million.

Large investments in marketing gave Naadam, the brand, wings at the start. But that’s not what’s sustained the company, particularly in the last two-and-a-half years. The same can be said of its so-called direct-to-consumer model. Though the company managed to ride the wave of the DTC era, it has always maintained diversified distribution, to its benefit.

“E-commerce is a meaningful channel for companies to build brands and interact with customers,” Scanlan said. “But [to ensure cash flow], brands in the future need to leverage wholesale relationships, retail expansion, private-label alternatives, off-price channels and, of course, e-commerce. To meet the customer where they are, you have to be everywhere, all at once. And Naadam has been doing that from day one.”

He added that the historical costs for an e-commerce business to acquire customers are no longer sustainable, “unless you’re capable of losing money year after year.” In the past, Naadam had chosen growth over profitability, seeing annual revenue increases of 100-250%. “But in this environment, where 100% growth is not attainable, profit is critical,” he said.

Like building Naadam the brand, what helped prepare Scanlan for Naadam Collective was his experience managing investment fund Magic Hour, launched in 2017 with retail executive Jake Sargent. The company made “a dozen or so” investments in early-stage, mostly consumer businesses, including beauty brands True Botanicals and Nécessaire.

Ad position: web_incontent_pos2

Described by Scanlan as “a hold co. for next-gen direct-to-consumer brands,” Naadam Collective has binding ties of companies with “ESG and environmental impact at the core.” The companies also exercise diversified distribution and customer centricity, and have proven brand-market fit. Early brand acquisitions have a follower with a built-in brand — a driving factor, Scanlan said in 2019, which he owed to the marketing savings. But now, he said, brands worthy of investment could simply have great products. A Gen-Z and millennial customer base is another common factor, though portfolio brands differ in their stages of growth.

What first gave Scanlan the nudge to embark on a multi-brand business was the opportunity in 2019 to acquire Thakoon from billionaire investor Silas Chou, former owner of Michael Kors and Tommy Hilfiger, and his daughter Vivian Chou. Silas remains a Naadam Collective investor and board member.

Shortly after Thakoon came Something Navy, which had proven its strength while in a Nordstrom-exclusive deal. Since, Naadam Collective’s scooped up 7-year-old apparel brand Ivory Ella, which supports elephant conservation, and Package Free, an e-tailer selling sustainable CPG products. In May, it closed its most recent acquisition, United by Blue, maker of clothing and accessories incorporating ocean waste.

Moving forward, Scanlan said the company will likely get “more aggressive” in its acquisition activity, based on timely opportunities and the current value a group positioning offers — namely, providing a ”safe harbor” for brands amid great market volatility and future uncertainty.

“There’s a clear need for consolidation,” he said. “And the modern direct-to-consumer space is ripe for this kind of shared backend service piece that promotes both profitability and growth. It’s unique in the category, relative to brands that are spending money to try and do it on their own.”

As Brian Linton, founder and CEO of 12-year-old United by Blue, put it, “We don’t have to be on our own brand island, and we can prioritize healthy financials,” since being acquired.

For its investment companies, the Collective provides shared resources that support the development of the brand and its products, as well as its distribution, among other functions. All the while, maintaining the identity of each brand is prioritized.

“One of the beautiful factors of LVMH is they let brands evolve; they give them the framework and the foundation to find their product-market fit and find their brand identity, and then support them through that growth,” Scanlan said. “Brands are unique things. And no one in [our] VC landscape or private equity landscape has internalized that the same way the Europeans have.”

The power of allowing entrepreneurs to “do what they do best” by expressing themselves creatively has been proven by Scanlan’s first owned brand, said Azimi. “What’s made Naadam great is all the things they’ve done that are completely outside the box,” he said.

Linton said, before entering deal discussions with Scanlan in January, he had also explored the idea of creating a holding company of mission-driven brands. He became sold on joining the Collective based on the portfolio brands’ common goals and the “shared ownership” of everything from data analytics to manufacturing facilities — Naadam Collective has 12 factories worldwide. Financing operations and supply chain management are also built-in.

“I’ve always had a mentality that collaboration is greater than competition,” he said. “My team and I are very open; we want to receive feedback so that we can make improvements and change the [brand’s] trajectory for the better. When I got into this, I didn’t realize how challenging it is to build a brand.”

Azimi said Scanlan has the “soft touch” needed when presenting brand founders with an acquisition proposal. “He’s lived through all the challenges that other entrepreneurs are experiencing. So he’s speaking from a place of experience,” he said.

Also providing support, based on where brands need it, is Naadam Collective’s team of experienced retail executives at every level of the business. In addition to Scanlan as CEO, the Collective’s C-suite includes COO Rijsemus and, as of Thursday, Shopbop and Jet Black veteran Sarah Sathaye, who just signed on as chief commercial officer. The companies also share “relationship opportunities,” including with distribution partners like retailers. In 2023, the Naadam brand is piloting international expansion, laying the groundwork for the group’s other brands to follow suit. The company is bulking up its dedicated staffers to support that future growth.

Naadam Collective is already a global company, if you factor in its continent-spanning offices, each with a specific focus. Production and quality control happen in Beijing, while financial and logistics-related operations are carried out in Amsterdam, overseen by Rijsemus. In the states, there’s Naadam’s international headquarters in New York, warehouse fulfillment and customer service in Rhode Island, and a new Philadelphia office, formerly exclusive to United by Blue.

Today, Naadam Collective companies are growing at a “healthy double-digit rate,” on average, Scanlan said. For its part, Something Navy saw 30% growth in the last year. It’s set to see a slight loss or break even in 2022. On August 19, the brand introduced a refresh inclusive of a price hike, and revamped products and art direction. It made for the brand’s biggest product launch day of the year, Scanlan said. Customers’ average order value was $400, double that of prior launches, and ROAS reached 16:1. The conversion rate on its website was 4%, and the marketing surrounding it attracted return customers. Through fall, the brand will focus on acquiring new customers with a broader digital and out-of-home marketing strategy. And it will release monthly product launches through EOY.

Based on its business model, Naadam Collective is taking a more advanced approach, compared to other “buy-and-build platforms, like Amazon and Shopify,” Azimi said.

“Those companies are buying subscale businesses, then they’re hoping that the consolidated EBITDA gives them a higher exit multiple,” he said. “But they’re not integrating the businesses [like Naadam Collective is].”

For Scanlan, getting there hasn’t been easy, from an outsider’s perspective. During a recent phone conversation, Scanlan said he was working from a hotel room while traveling with family. When asked about his usual workday routine, he said, “I’m working 24 hours a day. I don’t sleep; I get three to four hours a night. And dinner, one meal a day, is basically all I eat.”

Not that he was complaining. “I want to win,” he explained. “I love building. I love what we get to do and the people I work with. It’s all [part of the] process of getting to build something really special that hopefully lasts generations.”

Founders of DTC apparel brands are now a dime a dozen, but few brand leaders are making progress toward becoming the next leading conglomerate or even Gap Inc., in terms of their company’s generation-defining impact. Of course, the latter isn’t the goal of every entrepreneur in the space, with many seeing dollar signs — hoping to grow a company and cash out –—as opposed to being driven by a true passion for retail. Apparent members of the latter bucket are those few founders who, like Scanlan, found a winning brand recipe in a company they helmed and have since leveraged it to build others, along with cherry-picked collaborators. They include Frame co-founder Jens Grede, with the Popular Culture holding company that also trades in consumer brands like Skims. Having launched the Greatness Wins athletic brand with Derek Jeter in June, Untuckit’s Chris Riccobono seems to have similar aspirations.

“At the core of this whole [operation] is just love of brand,” said Linton, regarding Naadam Collective. “There’s so much passion for brand building — the creative side, the sales side, the partnerships. It’s energizing to constantly be able to speak to the brands we’re creating in a way that only brand founders can.”

Reading List

New York’s Soho is becoming a metaverse fashion retail hub

Bellroy CEO Andrew Fallshaw: ‘We always wanted to be an omnichannel brand’