Fashion brands are contending with a new social media platform, but TikTok and Instagram still hold their own. Meanwhile, in Europe, the European Commission wants the textile industry to start paying for its own waste. And one brand stole the show at Paris Couture Fashion Week. Don’t forget to subscribe to the Glossy Podcast for interviews with fashion industry leaders and Week in Review episodes, and the Glossy Beauty Podcast for interviews from the beauty industry. –Zofia Zwieglinska, international fashion reporter

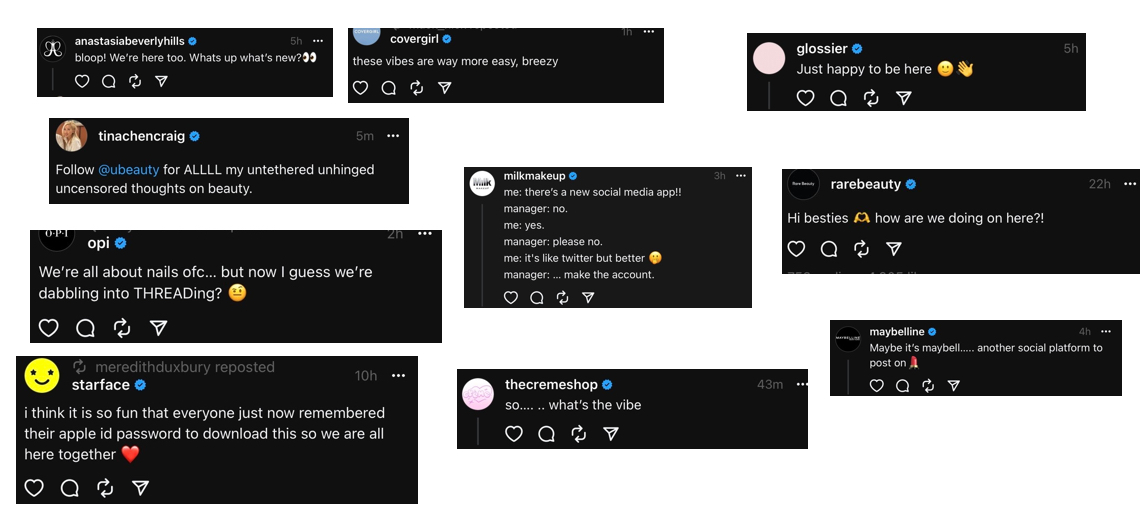

Meta introduces Twitter-rival Threads, and brands are getting in

Brands including Calvin Klein, Kith, Nike, Allbirds, Shein and Uniqlo are starting to explore Threads, the new Meta-owned, text-based social platform that launched on Wednesday. But s of Friday afternoon, no Kering or LVMH luxury brands had joined — no doubt they are weighing the benefits of the new platform before adding their storied names to its username database. Also, Threads is not yet available in the E.U. due to issues around personal data protection.

The app, which links to users’ Instagram accounts, could prove a valuable new channel for brands to engage with their communities. And, with the growth of ad networks across Meta-owned apps Instagram and Facebook, Threads is expected to focus on advertising, which could make it a more appealing brand choice than Twitter. As reported, both Twitter and rival platform Blue Sky have experienced challenges in attracting and keeping users. At the moment, there are no advertisements on Threads, but this is set to change over the coming months. So far, Netflix and Bravo have been invited to advertise.

RTFKT and gmoney — both web3 brand brands that are active on Twitter — have set up Threads accounts. The new platform begs the question of whether web3 brands, many of which have large, engaged communities on Twitter, will refocus their efforts.

Schiaparelli won Paris Couture Fashion Week

Paris Couture Fashion Week, which played out from Monday to Thursday, worked wonders to engage the fashion community and beyond. That was due to most of the shows going on amid local protests, the unexpectedly wearable featured looks, the wow factor of countless designs and, of course, the star power both on the runways and in the front row.

Ad position: web_incontent_pos1

The event’s buzz was evident in the number of likes and comments on Instagram posts featuring images and videos captured at the shows. According to Glossy-exclusive research from social media management platform Dash Hudson, the Schiaparelli show led the pack, in terms of Instagram engagement. The show had an engagement rate of 2.4%, while Viktor & Rolf, the show ranking No. 2 in engagement, saw 1.3%. Rounding out the top three was Jean Paul Gaultier, at 0.3%.

Instagram posts by the Schiaparelli brand made up three of the top-five Couture Week posts from the week, based on engagement. That was despite its lower follower count, compared to other participating luxury brands, of 2 million. The No. 1 post, seeing 133,300 likes and 1,500 comments, focused on attendee Cardi B who wore a statement Schiaparelli look inclusive of a voluminous wrap, bold gold jewelry and a headscarf.

Brands that operate in the EU may have to pay for textile waste

If a proposal issued on Wednesday by the European Commission is approved, companies that sell to consumers in the E.U. will be responsible for paying for the treatment of any waste textiles they produce.

Extended producer responsibility is becoming a larger issue for brands to contend with as waste and overproduction continue to grow. Reportedly, Zara launches about 10,000 new products a year, while ultra-fast-fashion brand Shein releases 6,000 new items every day. As not all items are sold and many are thrown away by consumers after a couple of wears, brands are behind a huge amount of waste landing in landfills each year.

Ad position: web_incontent_pos2

The fee that brands would be required to pay would depend on how easily the items could be processed and diverted away from places like Ghana’s Kantamanto market, where waste clothing ends up. The estimated fee for a T-shirt, for example, is $0.13.

To become a law, the proposal will have to be agreed upon in negotiations between E.U. member states and the European Parliament. It’s one of a whole host of regulation changes that could soon affect fashion brands selling to customers in the E.U.