As fashion retailers struggle to strike the right balance between AI-driven personalization and personal touch, a new e-commerce platform aims to set the standard.

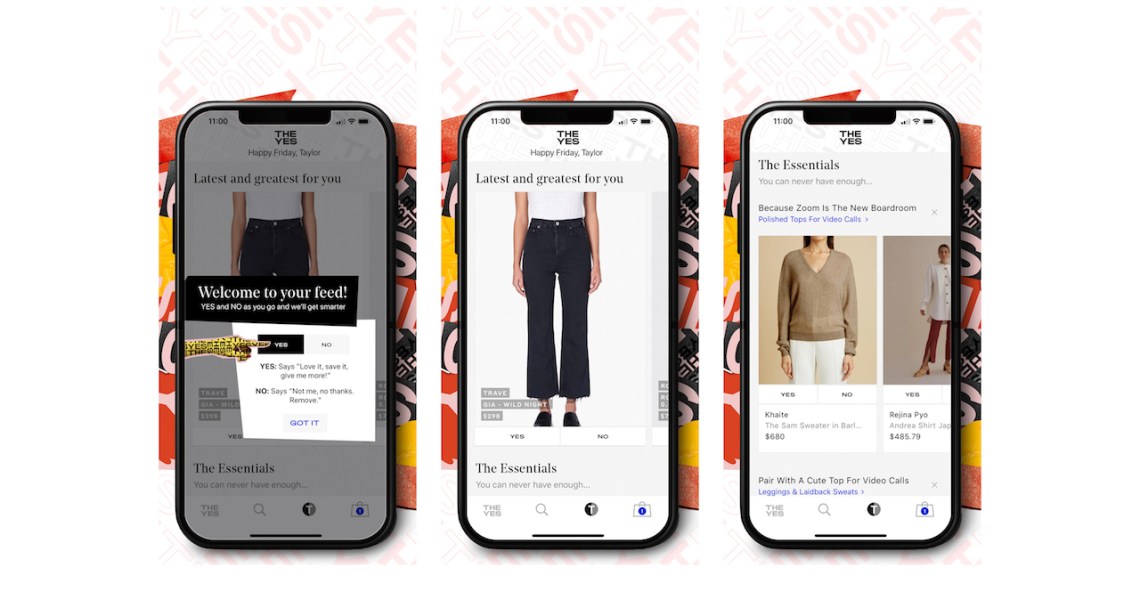

Launched on Wednesday, The Yes is promising real-time personalization through an app-based shopping platform that offers the complete product catalogs of 145 fashion companies, ranging from mall brands (Levi’s, Aritzia) to DTC players (Everlane, La Ligne) to designer names (Prada, Khaite). When a shopper designates a “yes” to a style they like, then styles that are similar will immediately move higher in their feed — this is guided by a team of taxonomists led by Taylor Tomasi Hill, former fashion director of Moda Operandi and Marie Claire. The Yes will launch with a total of 73,000 styles, intentionally spanning price points based on modern consumers’ shopping habits.

“There are all sorts of interesting things happening in machine learning and fashion, but unless a company understands the fashion category deeply and the consumer deeply, [AI] doesn’t get applied in a way that’s useful,” said Julie Bornstein, founder and CEO of The Yes. Formerly, Bornstein was COO at Stitch Fix, and before that, she was CMO and chief digital officer at Sephora.

“Similarly, you can understand everything about fashion and the consumer, but unless you know how to build the technology to support that, it’s really hard to be successful,” she said.

To carry out her vision of a platform that provides shoppers a custom shopping experience and opportunity for discovery, while also allowing brands to reach new customers, Bornstein compiled a team of fashion-tech leaders. Along with Tomasi Hill, co-founder and CTO Amit Aggarwal, formerly an engineering executive at Groupon, and Lisa Green, who ran ad sales for Google’s fashion retail vertical, have joined The Yes.

The Yes was in stealth for two years and set to launch on March 25. Bornstein opted to hold off due to coronavirus, but finally chose to press go this month, in the hopes that shoppers stuck at home will be intrigued by a new platform and a chance to “play,” she said. At the same time, she realized brand partners could benefit from buzz surrounding the app. For the first month, the company is donating $1 for every download to Good+Foundation, aiding families impacted by coronavirus.

Bornstein said The Yes’ partnership with brands is somewhere between a wholesale partnership and an affiliate partnership. The company gets an undisclosed “revenue share” of every sale made through the app. However, for the first two weeks after launch, the company is foregoing its commission.

Ad position: web_incontent_pos1

The Yes team used the nearly two-month coronavirus-related lull following the original launch date to sign on 10-15 more brands to the platform, including Acne Studios, Ganni and Alexander Wang. Also added to the app were a social sharing option, allowing users to compare their “yes lists” with friends, and the ability to shop full outfits featured on a single product page. The algorithm and search function were fine-tuned, though there’s still “tons more to do” to perfect the latter, said Bornstein.

Five-hundred beta testers helped steer the experience by offering feedback. They included friends of the brand and customers who enlisted via the splash page that currently makes up its website — most of those customers heard about the company when news of its funding rounds hit in October 2019. A website version of the experience is “definitely on the roadmap,” said Bornstein.

The Yes has raised $30 million in two rounds, from investors including Forerunner Ventures’ Kirsten Green and True Ventures’ Jon Callaghan. “We raised a lot of money initially because we had to build entire technology systems that didn’t exist,” said Bornstein. The business model, low in physical assets, ensures the company will be profitable and able to fund itself moving forward.

The pitch to brands concerned with brand alignment is that every customer’s experience and homepage is different. “If you’re someone who’s never going to buy Gucci, you’re not going to have Gucci in your feed,” said Bornstein.

But at the same time, the app is designed so customers will discover new brands, and brands will acquire new customers.

Ad position: web_incontent_pos2

“The traditional role of the department store is not working anymore, and customer acquisition through search and social media has become increasingly expensive,” said Lisa Green, svp of brand partnerships.

When signing onto the app for the first time, users are met with five sets of questions. Those include “What do you want to see in your feed?” Fashion brands are listed as answer options, meant to paint a picture of a shopper’s style, budget, go-to brands, as well as aspirational brands. “What do you never want to see in your feed?” offers up style elements, like “off-the-shoulder.” Size is also addressed, and The Yes accounts for brands’ sizing discrepancies when personalizing selections.

Tomasi Hill and her team built the foundation for the algorithms, which consider garment construction, garment elements and use cases, such as for work or for going out — neither of which is happening now. In addition, the team’s work ensures trends suited to each user are prioritized in their feeds. That’s based on the idea that the average The Yes user is someone who knows and cares about fashion.

Each brand has a storefront on the app, which links to their individual brand Instagram account and contains a field for shoppers to sign up for the brand’s email list. Bornstein said Instagram is not a competitor, despite its shopping features, as people are not going to that channel with the intent to shop. On Tuesday, however, Facebook and Instagram launched Shops, and teased additional shopping tools set to launch this summer. “It’s complementary, as fashion influencers on Instagram are certainly a way people are getting style ideas,” she said.

The Yes uses a dropship model, meaning it doesn’t hold inventory and brands ship products from their own warehouses. Brand sites are integrated with The Yes platform, enabling automatic transfer of product imagery and information. The Yes handles product tracking and other means of service through the app, email and text, via customer service platform Gladly. It offers free shipping and returns, and is expecting a low return late due to the direction it provides customers.

The Yes will be sharing relevant data with brands, including what styles are attracting “yeses,” what users are searching for and whether there are issues with the fit. Though collecting ample data, Bornstein said The Yes has no private-label aspirations and will instead inform brands of any white spaces worth filling. It also has no set plans to expand beyond women’s fashion to men’s fashion or the beauty category.

The company is counting on organic growth, having built up buzz with a “coming soon” launch countdown on Instagram (where it has 59,000 followers). Plus it’s expecting its large network of brands and industry friends to help spread the word — for brands, it’s provided social media-ready assets. Limited advertising includes “some test and play” across digital channels. The company is waiting to invest significantly in advertising until the app experience is improved.

But the rescheduled launch was not without challenges: Coronavirus-related obstacles are preventing Bottega Veneta, Balenciaga, Alexander McQueen and Saint Laurent from shipping to the states, so those brands are temporarily labeled as “coming soon.” Also, because brands are in promotions mode, the app was heavy in discounted goods out of the gate. And that’s not to mention that the economy is down and that consumers at home have little excuse to shop fashion.

“With so much physical retail closed right now, the time for consumers to experiment with new platforms is actually pretty good,” said Bornstein. “And we feel that providing a glimmer of hope and a vision for the future of retail is something that makes a lot of sense right now.”