This week, a debate about shopping’s tech-fueled next era. Scroll down to use Glossy+ Comments, giving the Glossy+ community the opportunity to join discussions around industry topics.

On May 10, Google announced a trial period of updating its search functionality to incorporate generative AI. For select users with access, the shopping experience will be expanded to serve up search results beyond the usual grid of products. That will include a summary of the item searched, prompts to expedite and best direct the search, and “information about the search you may not know you needed,” as explained by Stephanie Horton, Google’s senior director of global commerce marketing, while speaking this week at the Glossy E-Commerce Forum.

It’s the latest step in Google’s move to make shopping “more efficient, faster and smarter,” said Horton. And its users, who shop the site more than 1 billion times a day, have been taking to its advanced shopping features. Horton noted that 12 billion shoppers per month use Google’s visual search tool, Lens, marking a 4X increase from two years ago. They’re also leveraging Lens’s “multisearch” tool, allowing them to place text-based specifications around visual searches. For example, they could upload an image of a yellow skirt along with the word “pink” to see similar skirts but in the requested color. In addition, Google has been bullish on AR try-in. According to the company, it has 35 billion product listings.

“Consumers expect to be able to shop everywhere, seamlessly,” Horton said.

But while she said the new generative AI search, dubbed the Search Generative Experience, is a means “to help surface discoverability,” it’s clear that its capabilities are catered to those who, to some extent, know what they’re looking for.

As much of the industry braces for the end of shopping as we know it, based on Google’s news, some insiders are pointing to AI search’s shortcomings. Namely: It doesn’t facilitate discovery like, say, an afternoon in SoHo or a good ol’ trip to the mall. What’s more, it’s too …robotic. Instead, they’re betting on livestreaming and shoppable videos as the future of retail, largely based on its alignment with the current habits of consumers, particularly Gen Z.

In a conversation this week, Molly Langenstein, CEO and president of Chico’s FAS, recalled the start of the pandemic when the company received an abundance of inbound messages from customers. Most were inquiring about the job status and safety of “my person,” referring to a favorite sales-floor associate, she said. On a related note, U.S. shoppers, as a whole, seemed to be champing at the bit to get back to stores following the height of the pandemic. For months, based on high foot traffic, “retail is back” has remained a popular headline and shared sentiment among brand leaders. And digitally native DTC brands have increasingly entered or re-entered wholesale channels accordingly.

Ad position: web_incontent_pos1

The resounding message is that consumers consider humanity a valuable element of shopping. That’s missing from most online experiences — and AI doesn’t solve for that.

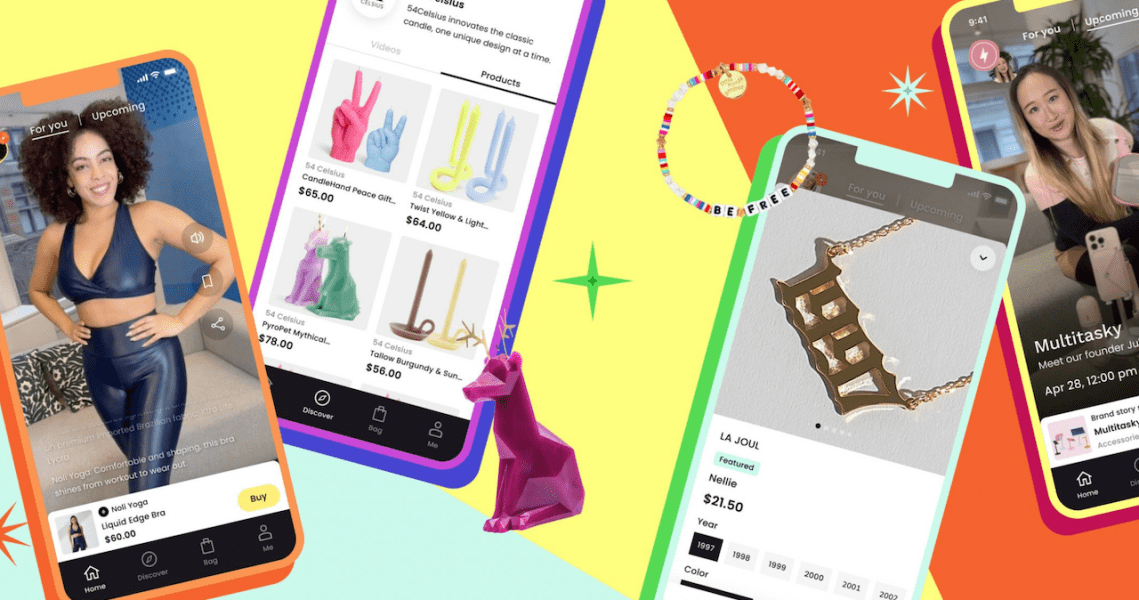

“E-commerce has made buying super convenient and efficient, but it isn’t fun; it’s crushed the joy of shopping,” said Brian Beitler, founder of video shopping app Sune, launched last month by QVC parent company Qurate Retail Group. “Shopping has entertainment value, even therapeutic value. But online, it’s missing the humanity and the serendipitous magic of discovery.”

Sune, which launched last month, is Qurate Retail Group’s play for younger consumers ages 18-29. As such, it was developed based on their habits: It’s mobile-based, centered on short-form video, and focused on unique products and brands with compelling stories, Beitler said. The hosts are personalities with a knack for storytelling, including influencers, actors and musicians.

Beitler stressed that Gen Zers still shop IRL. In fact, they’re more likely to shop in physical stores than millennials. “We want to give them a place to discover with their thumbs that’s as engaging as an in-person experience,” he said.

On the flip side, algorithms based on prior activity inhibit discovery, he said. Sune does feature a search tool, which serves up relevant videos and products.

Ad position: web_incontent_pos2

Sune, which currently sells 160 brands, leverages a marketplace model; brands enter a revenue share agreement when they join the platform. And, within minutes, brands’ e-commerce inventory can be loaded onto the platform, Beitler said. To get off the ground, the company has advertised on TikTok, Instagram and YouTube.

The goal, Beitler said, is for Sune to live alongside the big social apps on young shoppers’ phones and to be a go-to platform when they’re passing time and want to be entertained.

While social platforms have increasingly aimed to crack the e-commerce code, Beitler said their lack of a shopping focus will hinder their success.

“TikTok and Instagram have made using video a credible way to discover new products and be inspired to make purchase decisions. They’ve accelerated that in the U.S.,” he said. “But for them, [shopping] is a secondary reason for being. For all the great retail brands you love to shop, making shopping fun and entertaining is the core of what they do.”

That sentiment was shared by Meghana Dhar, advisor to the U.S.-based livestreaming company ShopShops. And, like Beitler, she called video the future of shopping. “The way I think about it is: Are you going into a playground or a shopping mall?,” Dhar said. “The internet can be your playground, and maybe one aspect of that is purchasing and shopping. But if you’re going into a shopping mall, your intent is to shop. … The same is true of a shopping platform; you’re not playing around.”

It’s worth noting that live shopping app Whatnot placed No. 9 in tech-focused VC firm Andreessen Horowitz’s Marketplace 100, released in March. The Marketplace 100 ranks the largest consumer-facing marketplaces. More than 100 Whatnot users reportedly made at least $1 million each on the platform in 2022. In the U.S., live-shopping revenue is expected to triple to $55 billion by 2026 and account for 20% of all e-commerce.

Dhar said she’s been bullish on livestream shopping since introducing Instagram Live Shopping to brands as head of shopping partnerships at Instagram. “I saw how much merchants and brands craved this kind of shopping behavior,” she said. She noted that Live Shopping became Instagram’s highest converting shopping format, owing that, in part, to the hosting creators. They build trust between brands and buyers, and move shopping “from a mandate to a conversation,” she said.

Likewise, retail advisor and investor Ken Pilot is betting on shoppable videos, also owing that to the “humanity” they bring to e-commerce. “Online shopping hasn’t changed. It’s gotten faster and easier to use, but you’re still going to a PDP, you’re still adding to a cart, and it comes to your house. It’s not exciting. There’s no conversation, no interaction, no personality.” He noted the rapid adoption of livestreaming in Asia. In China, livestream shopping drives 10% of retail sales.

Pilot is an investor in Firework, a tech company enabling brands and retailers to embed shoppable videos and livestreams into their e-commerce sites. To be successful in the states, he said, a livestream requires a host who’s a charismatic, eponymous brand founder, like a Todd Snyder or a Tory Burch. And to get the most bang for their buck, brands should make these videos accessible and shoppable until the featured products sell out. Pilot sees more potential in shoppable videos than one-and-done livestreams, he said.

Beitler agreed: “Young consumers don’t necessarily want to meet you for an appointment at your prescribed place in time.”

A scroll on Instagram Thursday morning showed a Carolina Herrera livestream in which the brand’s creative director, Wes Gordon, was playing host. He talked through a new collection’s looks worn by a rotation of on-screen models, as viewers commented with glowing reviews and fit questions. The video is no longer accessible via the brand’s Instagram account.

A Gen Z-focused brand actively hosting livestreams is Pacsun. Along with managing weekly shows focused on selling, the company livestreams its larger events to attract a broader audience. All livestreams play out on TikTok, and the weekly shows are filmed in Pacsun stores. According to vp of marketing Cristina Ceresoli, Pacusn’s sales via livestreams are growing “a little” over time, but viewership and interaction are increasing “a lot.” She expects that the engagement will eventually translate to sales. Each show is based on a timely theme, like festival dressing.

The weekly shows are “almost like a chat,” she said. “[Viewers] ask the host to try things on or describe what they feel like. And they almost always ask about something they see in the background that we weren’t intending to discuss. There’s something about the physical setting that is very exciting to customers.”

Ceresoli called the shopping livestreams “infotainment,” with customers wanting to receive information while being entertained, she said. Miki Guerra, who heads up Pacsun’s PS Reserve resale business, is among recent hosts.

On that note, resale platform Poshmark launched livestreaming via a Posh Shows feature in early April. And, of course, Google is also on top of the trend: YouTube expanded its live shopping capabilities through a new Shopify partnership last year. And, announced last week, it will soon be supporting YouTubers with several AI tools. Clearly, this is not an either-or debate.

Inside our coverage

Virtual try-on is table stakes for beauty brands, image search is growing

Veronica Beard’s founders: ‘Our stores are our greatest labs’

How fashion and beauty brands are keeping their top customers

Want to discuss this with our editors and members? Join here, or log in here if you're already a member.