Glossy’s Deep Dive: The Future of Fashion and Luxury is a collection of videos and key takeaways from our recent Future of Fashion and Luxury Summit Live that breaks down many of the most important changes impacting the industry today. You’ll find insights from forward-thinking founders such as Universal Standard’s Alexandra Waldman and Mejuri’s Noura Sakkijha, as well as actionable data from presenters including Klaviyo, Dash Hudson and Klarna. You can preview this Deep Dive below and buy it now for access to all session recordings and slides, and our future of fashion and luxury guide on-demand.

Fashion is facing a moment of transformation. The ongoing coronavirus pandemic has pushed the accelerator on trends that were already beginning to shape the industry, including the shift toward e-commerce, the need for more flexible sourcing and manufacturing models, the increasing importance of community, and the evolving role of store associates. It is also testing the resiliency of brands and retailers not only to withstand the crisis, but also to adapt to the uncertainty ahead.

Brands and retailers have an opportunity now to reevaluate what matters most to their customers and build relationships that will outlast the crisis. With stores closed, photo shoots on hold and shoppers’ daily lives upended, the industry has been forced to become more nimble than ever before.

The direct-to-consumer expansion into brick-and-mortar was moving rapidly prior to the lockdowns. As parts of the country begin to reopen, though, in-person shopping will look very different from what consumers are used to with capacity restrictions, enhanced cleanings and pre-scheduled appointments.

“No one knows what the uptake in foot traffic is going to be and how customers are going to embrace retail over these stages,” said Sakkijha. “It’s going to have to be an assessment of, ‘How is retail doing? Are people getting comfortable? Is our team feeling comfortable?’”

Ad position: web_incontent_pos1

Retailers will need to earn their customers’ trust, understanding that, for many, priorities have shifted and the personal connections they have with brands are perhaps more important than ever. Some are achieving that by opening new lines of communication, such as Slack channels, Zoom calls or video styling sessions, or by striking a more personal tone in existing ones like emails and social media.

“No one knows what the uptake in foot traffic is going to be and how customers are going to embrace retail.”

Noura Sakkijha, co-founder and ceo, mejuri

MM.LaFleur, for instance, launched a twice-weekly content series called “Content for Quarantine” featuring playful lists of links to cheer readers up, such as tips for indoor gardening in an apartment.

Founder and CEO Sarah LaFleur said she recognized that many of the brand’s customers were dealing with a stressful time and didn’t necessarily want to shop. “It’s not always about the sell,” she said. “It’s just making sure that the customer really understands that we understand where she’s at, and that when she’s ready to shop again, [she can] come back. We’re going to be here for you.”

What consumers have been buying has been closely tied to their changing reality, from stocking up on groceries and pet food early on to finding new hobbies, leading to a 105% increase in running-shoe sales and a 185% increase in DIY-project sales, according to Jenna Potter, head of beauty and accessories for Klarna US.

Ad position: web_incontent_pos2

How they’ve been buying has also been evolving, expediting demand for in-store and curbside pick-up, contactless payments and buy-now, pay-later. Consumers of all ages and income levels have adopted e-commerce out of necessity, and as online purchasing has grown, retailers are finding that new customers are driving this growth. The question now is whether these new shoppers will stick around and how much value they’ll bring in the long term.

While some of the disruptions we’ve seen in recent months may be temporary, many of the changes they’ve brought about are here to stay. In this deep dive, we’ll explore the trends that will shape fashion and luxury as they rebuild from the crisis and the strategies that are helping companies adapt.

Here’s what you need to know.

Brands need customers to survive, but community to thrive

Amid all the turmoil and stress of this moment, consumers are seeking out brands that offer them a sense of community and inclusion.

While neither of these are cultivated overnight, the brands leading the charge have a few things in common, including staying true to their values and making customers feel recognized.

One way they accomplish the latter is by featuring user-generated content, a tactic more and more brands have been employing during the pandemic as professional photo shoots have been canceled. Beauty brands like Morphe and Fenty are among the best at this, but throughout fashion — and increasingly even luxury — brands are finding ways to engage their audience on a more personal level.

- Building a community takes patience and consistency. Universal Standard has held strong to its guiding principle — fashion for everyone, free of size limitations — since it was founded in 2015. When it released a children’s book in April called “What Would Fashion Look Like If It Included All Of Us?,” the project garnered support from Chelsea Clinton and a host of other influential names. “There are so many people who are on the right side of this change and are just waiting to participate in making it happen,” said Waldman, the company’s co-founder and creative director.

- People are eager for connection and support right now. A trend MM.LaFleur has seen play out in real-time on its community Slack channel. Initially for VIPs only, it’s now open to customers and newsletter subscribers, and LaFleur sees the group offer support, build connections and share their cute dog photos with one another every day.

- New customers want to see themselves reflected in a brand’s marketing, and user-generated content can accomplish that in a more authentic way than any professionally cast campaign. “In addition to building that kind of that muscle as an organization to focus more on curation of content versus creation of content, one of the natural implications is that the content tends to be a lot more diverse,” said Kyle Wong, CEO of Pixlee.

Bottom Line: When brands are authentic about their message and inclusive toward every customer, audiences respond. In a crisis, these relationships are more important than ever, as people look for comfort and names they can trust.

There will be both opportunities and risks in physical retail

Brick-and-mortar today comes with an added layer of uncertainty: For one, while many stores are reopening now, we don’t know how long the pandemic will last and whether another outbreak could force cities back into lockdown mode. Businesses are also only beginning to get a sense of how profitable stores can be while limiting the number of shoppers inside and investing time and money in cleaning precautions.

“It’s really a new era of retail. Everything we knew about the retail associate is changing so rapidly.”

Ron Harries, svp and head of retail, Fabletics

On the other hand, the industry’s problems are so widespread — nearly half of U.S. commercial retail rents went unpaid in May — that companies with enough cash and growth will likely be able to negotiate favorable deals on real estate.

What’s certain is that stores today will have to provide a seamless link between digital and brick-and-mortar.

- As Fabletics staffs up for the eight new stores it plans to open in June and July, it is tweaking one key job description. Instead of “sales associates,” the stores will have “omni associates” who split their shifts between the brand’s physical retail locations and helping remotely with member services by phone and chat. “It’s really a new era of retail, that’s the simplest way I can put it,” said Ron Harries, svp, head of retail at Fabletics. “Everything we knew about that retail associate before the closure is changing so rapidly.”

- The brand’s member model and proprietary OmniSuite platform allow it to track what customers bring into fitting rooms, add to their carts or purchase, whether they visit a kiosk-style leggings bar, a full-size store or Fabletics’ e-commerce site.

- Mejuri offers digital styling appointments from its stores while they’re closed, and is expanding to curbside pick-up as restrictions ease. “Obviously we have to be very creative with what we’re doing with our spaces right now to temporarily bridge the gap between retail and online,” said Sakkijha.

Bottom Line: As the rapid rise in curbside pick-up and buy-online, pick-up in-store has demonstrated, customers increasingly expect some level of omnichannel capabilities wherever they shop. With so many retailers struggling to bring in cash — and some bankruptcies already underway — competitors may be able to capitalize if they’re confident in their continued growth.

Consumers are redefining their ideas around luxury

Even as the most rarified segment of the industry becomes more unattainable — with Chanel raising its prices last month as the global economy tanked — consumers are increasingly turning to resale as a side door into the luxury market.

Others are eschewing famous logos for a different kind of luxury: high-quality, thoughtful pieces that will last for years, a fundamental rebuke of fast fashion.

In either case, they’re developing loyalty — whether to a resale platform with a competitive buyback program or a brand that provides the building blocks of their wardrobe. Here’s how luxury is evolving.

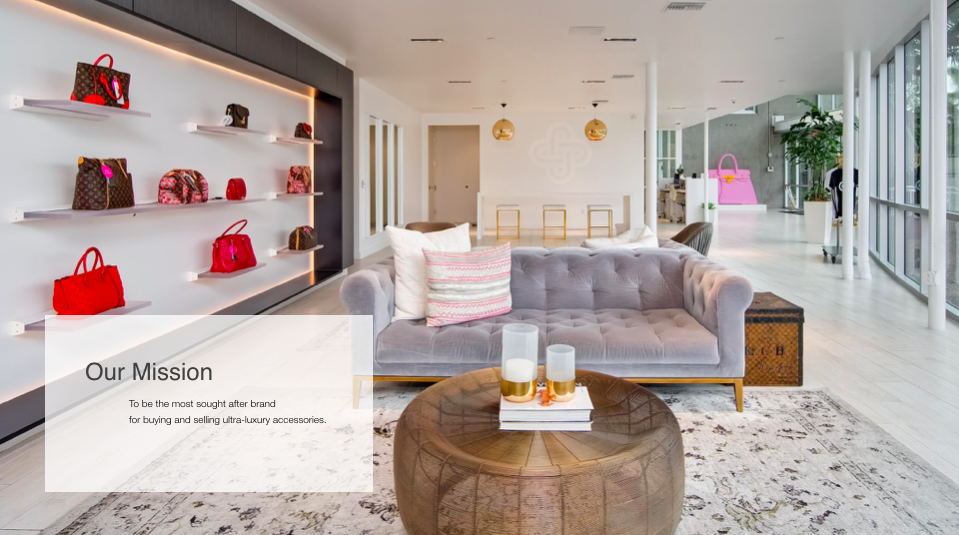

- While women used to buy Chanel’s classic handbags with the thought of passing them down over generations, “We have found that people now are looking at these items not as heirloom pieces — they’re actually looking at [them] as investment pieces,” said Sarah Davis, founder of Fashionphile. “And so people are now buying luxury items with thought in mind of, ‘How much am I going to sell this for?’”

- The last few months have given people a lot of time to think and reflect, and many could come out with different ideas of what they value. This new mindset, said Thakoon Panichgul, may look like this: “I’m going to really be careful about the way that I want to spend my money on clothes and I don’t want to invest in things that are not going to last for a very long time.” In that case, fashion’s “new, new, new” imperative will need to be reexamined.

- At Cuyana, co-founder and CEO Karla Gallardo is laser-focused on quality so customers can get the most wear possible out of each item. To that end, the brand now offers a line of leather care products to extend the line of its accessories and will soon launch repair services in its U.S. locations.

Bottom Line: While both pre-owned items and products built to last are concepts that have been around for generations, they’ve taken on new meaning in today’s world. Sustainability is a key factor. And as more shopping shifts to e-commerce, luxury purchases are no exemption, particularly if people remain skittish about contracting the coronavirus in public.

Flexibility will be a top priority

If the traditional fashion cycle seemed archaic before the crisis, the events of the past few months may be what finally pushes it into obsolescence.

Purchasing and production decisions made a year ago suddenly lost relevance as stores were forced to shutter, events and travel were called off, and people prepared to hunker down at home. Since then, brands that rely on wholesale have found themselves in the lurch as department stores have canceled orders and consumer spending has changed focus to categories relevant to their new lifestyle. The most successful companies have been those with the flexibility to reallocate inventory, quickly shift their production and meet their customers where they are.

“What we’re seeing is a crisis like this can put a lot of retailers in an uncomfortable position, because there’s a lot of inventory that may not be relevant for [their customers],” said Gallardo. “This is where a supply chain like ours, which is a little bit more of a fast-response supply chain, really helps.”

“I think everyone should be trying to do something new,” said James Miller, CEO of The Collected Group, which owns Joie, Equipment and Current/Elliott. “It’s not just a notion of [opening] up an e-commerce site. It’s how, for example, you activate inventory that otherwise is sitting in a box, sitting in a large industrial warehouse somewhere in the world, where it could be selling somewhere for someone.”

Here are some ways brands are building this kind of adaptability into their business.

- For her luxury plus-size clothing startup Henning, Lauren Chan began pivoting toward an on-demand production model in late 2019, planning to offer a core collection of staples to wholesale partners alongside made-to-order seasonal pieces sold DTC. When the pandemic hit, she heard from wholesalers that they were canceling fall orders and holding off on buying new product, but the brand’s DTC business means it’s not stuck with piles of inventory. “We’ve skirted a lot of the issues that a lot of the major VC-backed companies have been facing, like over-staffing and over-production,” said Chan.

- Flexibility is also about finding new channels for unsold merchandise. The Collected Group piloted a partnership with Farfetch to introduce Equipment products to new customers. It also launched a service to reduce customs duties for international customers, which so far has increased international orders by 350%, and has begun selling select complementary loungewear and basics styles across all three of its owned sites.

- Marketing materials need to be adaptable, too, as MM.LaFleur discovered when it retooled its product imagery to suit a work-from-home lifestyle and began cropping models’ feet out of photos so you couldn’t tell they were wearing heels. “I know that they’re great work-from-home clothes and great lounging clothes, but it’s really up to the brand to be able to show that to the customer,” said LaFleur. “You really need to go the extra mile to make sure that you’re representing it to her in the right way.”

Bottom Line: Brands and retailers need to think on their feet and adapt quickly to ensure they stay relevant, and having the systems in place to do so before a crisis hits will be a competitive advantage. Customers are more receptive to change than one might expect — but communication and recognition are key.

Scrappy marketing tactics will carry over post-pandemic

The industry had to throw its content calendar and marketing plans out the window and come up with something better suited to customers’ new reality — and in some cases, these changes are going to stick even after people resume a more normal day-to-day.

When it became clear that in-person events and outdoor billboards wouldn’t be relevant for a while, Miller said The Collected Group’s marketing and PR teams shifted focus to finding a new tone of voice for the brands’ Instagram handles.

“The biggest advantage right now is to be completely connected with your customer.”

Thakoon Panichgul, founder and designer, thakoon

“As we got up and running, it was just, ‘Let’s throw everything, sort of, caution-to-the-wind and see what sticks,’ and what tends to get more of an appropriate reaction from us tends to be the more grassroots content that we provide,” he said. “So that doesn’t mean to say that we have to work with influencers who’ve got hundreds of thousands of followers; it’s more the idea of working with people who’ve got a place in business, a reality of what’s going on at home, something that really is more meaningful, [in order] to connect on a much more personal level with our audience.”

While it was borne out of necessity, this change will continue to have an impact for months and years to come.

- As video game usage has surged, brands like Valentino and Marc Jacobs have debuted in “Animal Crossing: New Horizons,” creating downloadable virtual collections for the game. According to Marie La France, executive director of corporate strategy at Dash Hudson, Valentino’s Instagram post about the collection saw 100% higher engagement than its previous week of posts. “Instead of live streaming models walking around their homes, these brands have found a new captive audience, creating an innovative avenue for building brand awareness and affinity,” she said.

- Employees are often among a brand’s most effective ambassadors. Retailers are leveraging short-form video to scale the one-on-one interactions sales associates have with customers, creating content that’s more educational than lifestyle-oriented.

- Forging a personal relationship with customers is a win for both sides: Brands get to better understand what their audience is looking for, and customers feel an emotional attachment to the brand. “The biggest advantage right now is to be completely connected with your customer,” said Panichgul. “I’m more engaged on social media now. It’s really kind of [like] going into [customers’] living rooms and making that connection. And that’s long-term, it’s not a one-off.”

Bottom Line: Marketing doesn’t have to be expensive to be effective. While there’s a place for high-production photo shoots and events when they’re possible again, brands are discovering the potential return on investment for scrappier everyday content and out-of-the-box activations that acknowledge the changes in their audiences’ lives.

Overheard

“If you are doing something charitable, then you should really be doing it throughout the month, not just to mark certain calendar dates or to capitalize somehow on an opportunity. I think that people are getting really wise to that… They really want to see something that’s a little bit more authentic.”

Alexandra Waldman, co-founder & creative director, Universal Standard

Brands can no longer get away with opportunistically aligning themselves with a cause in order to win favor with consumers. As Pride month and the Black Lives Matter movement have proven in recent weeks, audiences are both savvy to brands’ year-round actions and willing to call out hypocrisy when they see it. At Universal Standard, Waldman and co-founder Polina Veksler have prioritized consistency in their messaging and behind-the-scenes practices, Waldman said, and that investment continues to pay dividends in attracting long-term customers who are eager to tell friends and family about the brand.

This authenticity will only become more important as spending shifts from physical retail to online, she said, because shoppers have less of an opportunity to stumble upon a brand’s products by chance and will instead be seeking out companies that share their values.

“It turns out that when you sell a product to a customer and she uses it over and over again, she ends up loving your brand and ‘marrying’ your brand, and when that happens, a fair share of wallet will be dedicated to your brand.”

Karla Gallardo, co-founder and CEO, Cuyana

While Cuyana’s philosophy of “fewer, better” may seem counterintuitive for a company that needs to continue to sell products to survive, Gallardo argued that the brand maintains a higher average order value and higher lifetime value than competitors because its customers keep coming back.

The fast-fashion method of chasing trends at the expense of quality has come under increasing scrutiny in recent years, and while it may have generated billions, it doesn’t necessarily inspire loyalty in the same way as building trust over time. As consumers become more intentional with their purchases — whether out of environmental and ethical concerns or financial constraints — companies that have proven their integrity will come out on top.

“Authenticity is, quite frankly, more important and valuable to Fashionphile than it is even to the brands [we carry] on some level. It would shut our business down, having those issues. And so we care deeply about that.”

Sarah Davis, founder, Fashionphile

Fashionphile only accepts 51 of the top luxury brands on its consignment platform for a reason: It has the expertise and technology to guarantee its authentication of their products. While counterfeits today have become so advanced that even brands themselves can be challenged identifying them, Fashionphile’s reputation is on the line every time it accepts a product for resale.

Since bringing on Neiman Marcus as a minority investor last April, the company has been able to cultivate closer relationships with the brands it stocks. In some cases, it has invited brand teams to its headquarters for a look at how it handles authentication, a process that includes specialists trained via in-house certification courses, infrared technology, digital Pantone readers and RFID.