The opportunity for beauty brands in off-price retail stores has never been better. But at the same time, the strategy between leading retailers couldn’t be more different.

Over the past few weeks, Glossy has reported on the strategies at off-price shopping centers like Tanger Outlets and at discount retailers like Nordstrom Rack and Saks Off 5th, all of which have added full-price beauty wares to their selections to bring new shoppers into their shopping channels.

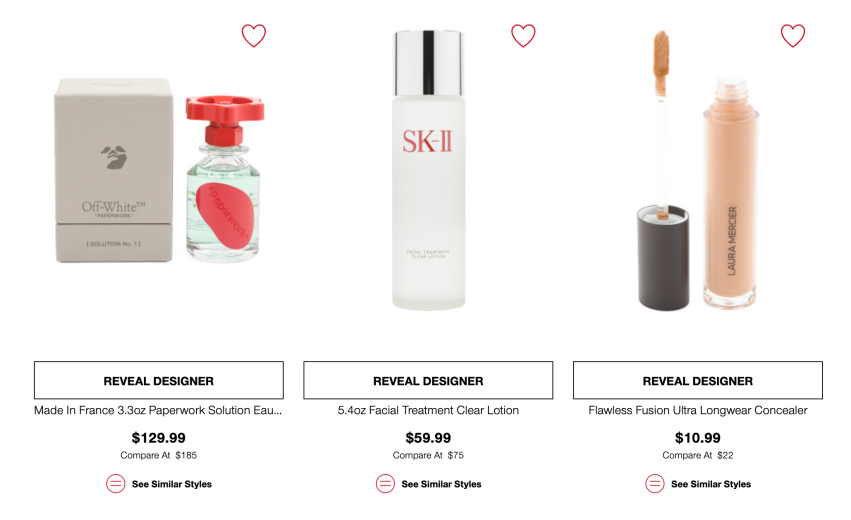

But on the other hand, there is a booming business staying true to the deals discount shoppers are accustomed to: 30 to 70% off MSRP. TJX, which owns TJ Maxx, Marshalls and Homegoods, has expanded its beauty footprint with a larger selection and more prestige products.

With more than 4,900 stores in nine countries, plus six e-commerce sites, TJX leads the traditional discount department store space. This includes more than 1,300 T.J. Maxx, 1,100 Marshalls and 900 HomeGoods locations in the United States. For its fiscal 2023, the company’s net sales were $49.9 billion, an increase of 3% year-over-year. In its latest earnings, reported in November, TJX reported $13.3 billion in net sales for the third quarter of its fiscal year 2024.

Ross Stores provides competition through more than 1,700 Ross Stores and 347 dd’s Discounts, the latter of which offers a more moderately-priced selection of apparel, footwear, accessories and home goods. Together, cosmetics, accessories, lingerie and fine jewelry make up 14% of the store’s wares. The group’s revenue for its last full fiscal year, which was 2022, was $18.7 billion. Ross does not, however, sell online.

By definition, discount department stores offer customers products priced below MSRP and often much lower than comparable merchandise at big box, mass and traditional department stores. This category is defined by its many brands and by-category layout, and unlike traditional department stores, which offer cash wraps in each section, discount department stores often place the checkout for all items at the front of the store.

Ad position: web_incontent_pos1

“[Discount department stores] are a big place for overstock from distributors and a way for brands to make quick cash through liquidator distributors,” Ina Subramanian, former CMO and svp at several beauty brands, told Glossy. This includes when products are overproduced, returned to the brand or distributor from a different retailer after not selling, no longer seasonally relevant, limited-edition, or reformulated and repackaged.

It’s also how brands in financial distress can boost liquidity through the speedy sale of excess inventory. This is how Glossier made its way into TJ Maxx stores in 2022, according to people familiar with the company’s financial situation at that time.

TJX declined to share specific information about its beauty category, sourcing or brands. Brands seen in TJX stores by Glossy, such as Clinique, Kate Somerville and Laneige, declined to participate in this article.

“Most of the off-price retailers are quick to make decisions on well-known brands and, due to their footprint, the units can be significant and therefore inventory can be converted to cash quickly,” said Rose Fernandez, a veteran beauty brand leader and current consultant who most recently served as CEO of Algenist. And unlike an Ulta Beauty or Sephora, contracts are straightforward: Discount department stores do not return goods or charge a brand for in-store placement, marketing or discounts, which all cause brands to take a hit on their margins.

Reformulations are also a common way brands end up in a discount store. For example, Glossy spotted Kate Somerville Eradikate Clarifying Acne Gel Cleanser for sale at TJ Maxx in January in Los Angeles for $9.99, while the same, slightly revamped formula currently goes for $60 at Sephora.

Ad position: web_incontent_pos2

Traditionally, being distributed into a discount department store takes place through a third-party distributor, which makes it hard for some brands to track just how their products end up there, according to Judah Abraham, current founder and CEO of Slate Brands. Abraham got his start in the beauty industry working at a wholesale supplier and distributor that works with retailers like TJX.

Keeping its sources anonymous is one reason why this type of off-price retailer is traditionally more secretive about its processes and products. It also deeply impacts margins for both brands and distributors.

Sources familiar with this industry told Glossy that, if products are coming directly from the brand and the brand is comfortable with the retailer displaying the product or brand name online or in marketing materials, they can negotiate a much higher rate for the goods. Still, some brands may forgo a higher margin to have their products sell without making a splash on e-commerce or social media.

Abraham told Glossy that, oftentimes, with large brands, products may be sold directly from the brand but come through a different internal selling channel, such as sellers that usually work within Duty Free channels.

Then there is the growing number of brands creating bespoke products specifically for discount department stores. To avoid alienating their other retailers, they bundle products or create new sizes or colorways just for the discount retailer. Sources Glossy spoke to estimate this makes up about 30% of discount department store beauty merchandise.

This is opposed to products coming from third-party distributors, who often own the products outright but can lack the distribution rights to negotiate on behalf of the brand in any way. These distributors can procure goods in a variety of ways. Some buy products directly from the manufacturer to sell on specific channels, then quietly decide to redirect some or all of the goods to a discounter due to a variety of conditions. Large brands, for example, often offload their entire Amazon or Walmart distribution to a vendor. To do so, the brand often sells the goods outright to the distributor and authorizes them to sell and market on its behalf on certain channels.

Depending on the agreement between the brand and distributor, unsold goods may end up in a discounter without the brand knowing which distributor they came from. Any company that can prove it procured the goods in a legal way, whether or not it has permission from the brand to sell in a specific retailer, can sell into a discounter. “Our merchandise vendors guarantee that the goods they supply to us are authentic and in compliance with all applicable laws, regulations and industry standards,” Andrew Mastrangelo, assistant vp of global communications for TJX, told Glossy.

For example, a retailer shutting down or not being able to sell the committed amount of product may need to quickly liquidate its inventory. Others may buy goods from a retailer that is unable to return the unsold goods to the manufacturer and must liquidate the merchandise.

This type of distribution is often referred to as the “gray market” or “parallel trading,” where a distributor — also referred to as a “trader” — has the legal right to sell the goods, but lacks the brand’s permission to do so or is not an “authorized seller.”

One source told Glossy that, without distribution rights, products are often sold to retailers for 10% or less of the original MSRP.

Negotiations between sellers of any kind and discount department stores also include how the retailer can or cannot present the items on e-commerce. “Brands that prefer to obscure their identity online often receive much less for goods,” one source, who preferred to remain anonymous, told Glossy.

TJ Maxx, for example, obscures some brand names on category pages and brand lists online through a plug-in that is similar to a CAPTCHA security page, which disappears when a shopper clicks on the product page. This is, in part, to prevent products from being crawled by Google for shopping search returns, web searches or Google alerts set up by brands or retailers tracking their goods.

“Some [web] crawlers can click [on links like this], but most can’t,” said Adam Ayers, outsourced chief technology officer at Number 5, which provides tech help to celebrity, lifestyle and e-commerce brands.

This technique can help brands selling into off-price stores make quieter transactions and, in turn, make good on promises to other retailers who may have terms in their agreement that prevent other retailers from undercutting them. In this case, what a retailer doesn’t know can’t come back to haunt the brand later.

But this can also mean counterfeit products could find their way into discount department stores’ stock, and expired products are more commonly found than in other stores that work directly with all brands.

“Our buyers do not knowingly buy expired or damaged merchandise and are trained to look for products with expiration dates,” said TJX’s Mastrangelo. “If we are alerted to a potentially fraudulent item, we look into it with the appropriate members of our buying department and then take the actions that we believe to be appropriate, which could include removing it from our sales floor.”

Despite smaller margins, many brands include discount department stores in their business strategy for a variety of reasons. “It’s a great way to reach a new demographic,” said Subramanian. “It’s almost like you’re making money on sampling.”

“I have heard from [traditional retail] store teams that a customer will come in looking for something specifically because they found it at an off-price retailer, have fallen in love with it and can’t find the item there any longer,” said Fernandez. “Off-price can be wonderful for discovery.”

It can also be an insurance plan for brands weary of troubled supply chains. Subramanian noted that brands often sit on what’s called “pack and hold” inventory, which they have purposefully overordered to ensure backup stock for stores or vendors, knowing it may end up being sold to a discounter if unneeded.

“[This type of retail] is not for every brand, and it certainly shouldn’t be a large part of your distribution. But it can have a place and add value in various ways,” said Fernandez. “[However] this is not a channel where a brand is making a significant margin, so there needs to be a business reason.”