Men’s direct-to-consumer brands Hawthorne and Huron are the latest companies trying to own the bathroom.

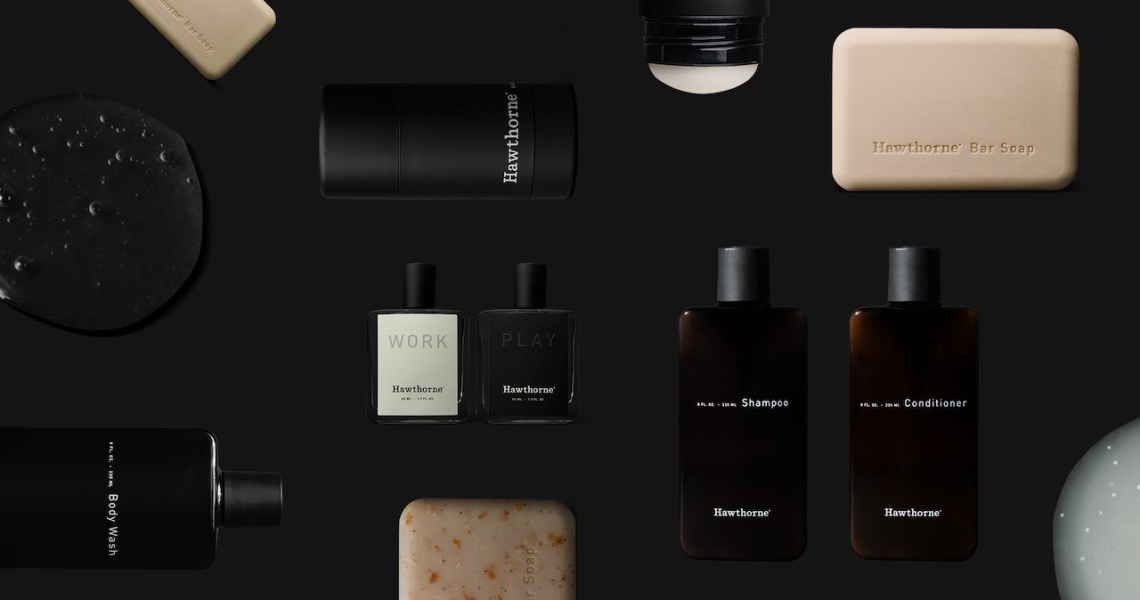

Following its recent move into body care (deodorant, soaps and body wash) in December 2018, Hawthorne, which creates customized grooming solutions, is expanding into hair care on Tuesday with a line of shampoos and conditioners. Like Dollar Shave Club and Harry’s that recently expanded beyond razors to include fragrance, deodorant and butt wipes for the former and hair care for the latter, 3-year-old Hawthorne previously only sold one hero product: cologne. For its part, DTC brand Huron launched on Monday and sells a line of three core products — face wash, body wash and face lotion. It is focused on bringing premium skin care to a mass audience.

Hawthorne and Huron are not just trying to steal market share from older digital natives like Unilever-owned Dollar Shave Club and Harry’s, which was acquired by Edgewell Personal Care Company in May. They are also laser-focused on moving in on heritage men’s players, namely Old Spice and Head & Shoulders.

“We’re creating true preference for these men who have been used to using Old Spice or Irish Spring, and we’re not saying there is only one product or answer for them, like Head & Shoulders 2-in-1 shampoo and conditioner,” said Brian Jeong, Hawthorne CEO and said co-founder. “There has been very little opportunity for discovery in men’s grooming, and what has worked for us is when we say, ‘Tell us a little bit about yourself, and we will take care of the rest.'”

Hawthorne, which saw 1,000% sales growth in 2018, has relied on a personalized quiz and algorithm informed by artificial intelligence to understand its male shoppers’ habits, including their skin care, alcohol preference and smoking habits. Three new questions were added to Hawthorne’s existing 18-part questionnaire on Tuesday; now 50,000 product formulations are possible, based on the brand’s seven core hair types.

The $8.9 billion U.S. men’s grooming market is forecasted to grow by over 7% by 2023, to $9.5 billion, and hair care is accelerating even faster, set to grow 17% to $904 million, per market research firm Euromonitor International. Still, men’s hair is currently dominated by legacy players. Combe Inc.’s Just for Men ranks No. 1, followed by Unilever’s Axe and L’Oréal Groupe’s L’Oréal Paris. Companies far and wide, from barbershops such as Fellow Barber and Johnny’s Chop Shop, and retailers like Target with private-label line Goodfellow and Co, want a piece of the pie.

However, Huron is not necessarily focused on relaying that more products are a better customer experience, which is why it is only offering three products at launch — the minimum grooming routine required for any male, said Huron founder and CEO Matt Mullenax, who cut his teeth at Bonobos.

Ad position: web_incontent_pos1

“Guys are taking better care of themselves in other categories and yet they are reverting back to the same bathroom products they’ve used since middle school because there isn’t a brand that speaks to them,” said Mullenax.

Dollar Shave Club and Harry’s were able to prove formidable competitors to Gillette and Schick, not just through ease, but also price. Hawthorne and Huron are more expensive than, say, a Head & Shoulders shampoo or an Old Spice body wash, which sell for $3.67 and $5.87, respectively. Hawthorne’s new shampoo and conditioner are $19 as one-offs ($17 via subscription; its cologne retails for $100), while Huron’s products are $14 and $15, or $20 for a three-product kit.

Huron, for one, is after second-tier markets like Austin, Minneapolis, Chicago, Detroit and Kansas City, upon comparing men’s personal care spend-by-zip code, by approximate customer acquisition costs via regression analysis. “It proved that these are cities we should be excited about,” said Mullenax, without stating exact figures. “A lot of other brands are not focusing their time and efforts in those places, but in 2019, the consumer in those cities is savvier than other companies give them credit for, and the shopping experience is even more bifurcated there.” To indicate this push, Huron is featuring a diverse array of real men versus models in its digital and social campaigns.

Though Huron is leaning toward the DTC-model, it will sell in a select array of speciality stores in the aforementioned cities, like Fourpost’s Mall of America location. Hawthorne, however, will remain DTC-only for now, in the hope of continuing to integrate customer preferences into product and content for a stickier experience. For instance, since launching body, it has seen its product return rate reduced from 17% at its highest in 2016 to less than 1% this year. Hawthorne credits that change to its constant consumer feedback loop. Still, Jeong said the majority of its shoppers also reside in Middle America versus California and New York, which only account for 20% of its customer base.

“You go to Duane Reade and Target, and you see 20 different deodorants or shampoos, and there is no differentiation beyond their primary function. When you think about products that are more elevated, like Jack Black and Baxter, it may be a better product, but they are sold in places where men don’t go,” said Jeong. “Men don’t go to Sephora and men don’t go to Blue Mercury.”