As the wellness market increasingly stretches to include organic tampons and condoms, as well as pharmaceutical drugs, supplement company The Nue Co. is looking to provide guidelines on what the $4.2 billion wellness industry is and what it isn’t.

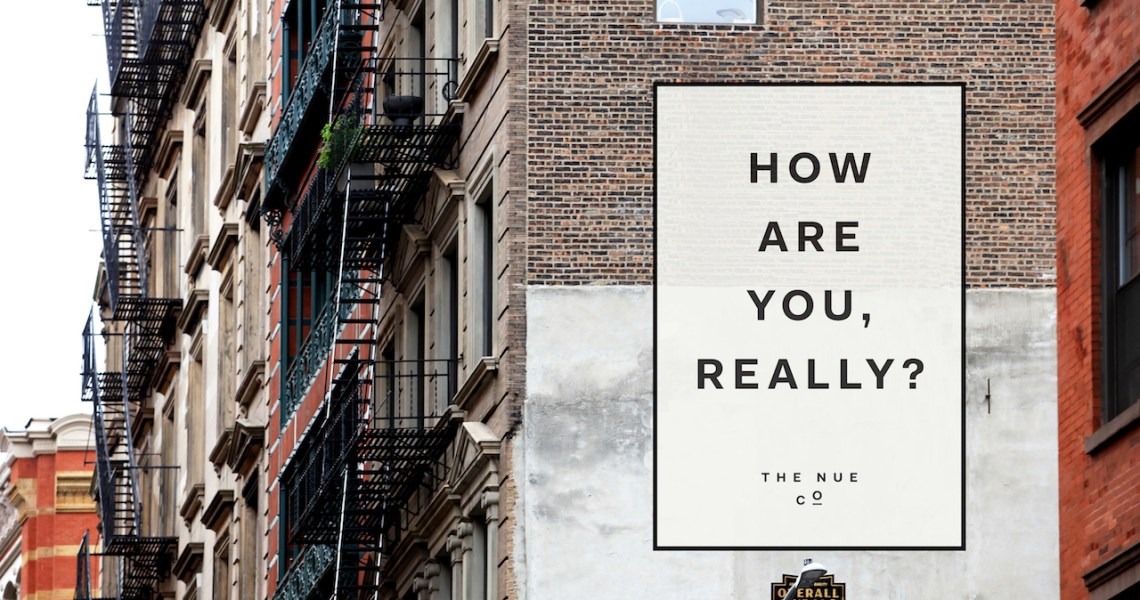

Beginning Oct. 7, The Nue Co. is posting questions about mental health — such as “Are you here right now, or somewhere else?” and “How are you, really?” — in its latest guerrilla out-of-home campaign in Los Angeles and New York. Across the two cities, advertisements will be present in 30 locations. Done in collaboration with Koreen Odiney, the artist and influencer behind the campaign-platform “We’re Not Really Strangers,” The Nue Co. is emphasizing underlying issues within wellness such as stress, sleep, exhaustion and loneliness, versus somewhat prescriptive “rules” for wellness like Instagram’s Selfcare Sunday selfies.

“Asking about what true wellness is is a good place to start. For the last decade, people have thought about health and wellness in the context of just food and exercise. It is no longer a conversation about calories in and calories out; consumers want more information,” said Jules Miller, The Nue Co. CEO and founder. “We see this as a merging of physical health with mental health, because it doesn’t matter how good one appears from the outside. The wellness market has to encompass more beyond clean ingredients and an outward appearance.”

Beth McGroarty, vp of research at the Global Wellness Institute, echoed Miller’s sentiments. “There seems to be a need for more regulation within wellness, especially as companies position products as cure-alls,” she said. “This is especially true if a product has or can have very harmful effects on one’s health.”

After launching in 2017, The Nue Co., which is sold on its e-commerce site as well as through select partners such as Goop and Net-a-Porter, did more than $1 million in revenue in its first year and is on track for 400% growth in year two. It has become a standout story within the larger ingestibles beauty space, which has been left unregulated and, therefore, has had suspect effects on customers, thanks to products like Flat Tummy Tea. In June, The Nue Co. raised its first funding round of $9 million led by venture capital firm Waldencast, along with Unilever Ventures.

Like Native deodorant, which has turned its advertising spending to television due to growing customer acquisition costs via digital channels, The Nue Co. is now spending just 37% of its advertising dollars on Facebook and Instagram down from 2017 and 2018. Miller would not disclose the cost of the company’s latest advertising efforts, but explained the shift is to focus on loyal customers and continued retention. Presently, the Nue Co.’s repeat purchase rate is over 50%.

The Nue Co. sees this as a multifaceted campaign, in that it is directing customers to its own channels versus retailers. It is not pointing to one solo product or launch, and purposely focused the campaign on billboards to combat digital screen time issues. Odiney has 699,000 followers on Instagram, while The Nue Co. has just over 44,000, so the company is indeed hoping to expand its reach. Beyond Odiney, The Nue Co. is working with 300 unpaid influencers to share their stories of body image and social media stress. Across channels, Miller expects a 60% bump in monthly traffic.

Ad position: web_incontent_pos1

In November, the brand will launch its Gut+ collection, which deals with sluggish digestion and chronic bloating, which Miller sees as medical concerns linked to stress. The Nue Co.’s best-selling products, including its Sleep Drops and Defense Drops, are all related to stress, and stress is the No. 2-ranked need state within The Nue Co.’s assortments. In 2020, it is launching all new need-state collections, with clinical studies, pegged to its funding raise.

“Brands have to diversify their marketing spends; more and more people are starting to realize that Facebook and Instagram are not something you can rely on alone, and even new DTC brands are launching out of the gate with out-of-home,” said Miller. “We saw this shift, and we needed to find a way to connect to our consumer in a very crowded marketplace.”