While Snapchat has had its ups and downs over the past few years, it’s seeing a comeback. With Gen Z furiously sending Snaps during the coronavirus shutdown, beauty brands have been turning to ad opportunities on the platform’s curated content.

According to Snapchat’s Q1 2020 earnings report released on Tuesday, the platform gained 11 million new daily active users during the quarter ending March 31 for a total of 229 million. This marked a 20% year-over-year increase. Now that its Stories feature has lost steam to Instagram’s own version of Stories, the company is emphasizing the growth of private messaging and its curated Discover section. Snapchat reported that both have been increasing during the Covid-19 shutdown: Private messages increased by 30% in the last week of March, while daily time spent watching Discover content grew by 35% year-over-year.

Beauty content has been especially popular on Discover. The company highlighted its Snap Original “Nikita Unfiltered” series about transgender beauty influencer Nikita Dragun launched in March 2020, which has received over 20 million views. Other popular beauty content creators and publishers on Discover include Insider, Jellysmack, Refinery 29 and Hearst, which have all been creating quarantine-related beauty content. They have each seen between 4.5 and 20 million views in March, according to Snapchat. The 20 million view count went to Jellysmack, which has created content on beauty hacks and cutting your hair at home.

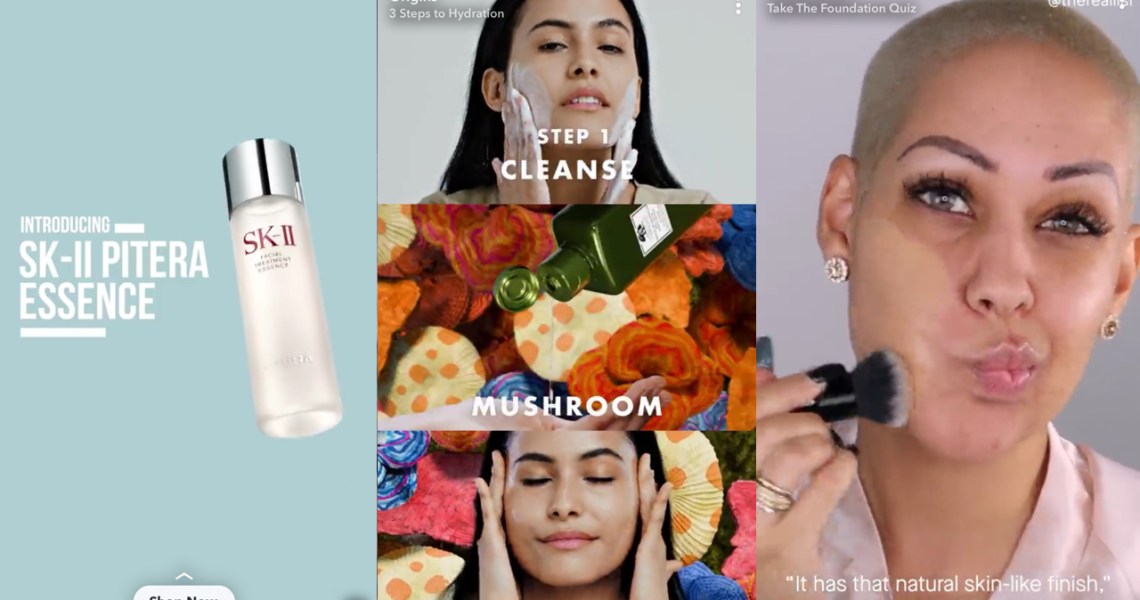

Beauty brands have also gravitated toward the Discover section for advertising. Estée Lauder brands running ads during the quarantine shutdown include Clinique, Tom Ford Beauty, Origins, Bumble & Bumble and Too Faced. Estée Lauder declined to comment on whether or not Snapchat ad spending increased or decreased during the Covid-19 pandemic. Procter & Gamble brands SK-II and First Aid Beauty have also published ads to Discover, while other companies advertising include Sephora, Göt2b, Cover Girl and Il Makiage.

Snapchat Stories usage is more limited among beauty brands, although Sephora is still posting during the quarantine, as are influencers with beauty labels including Huda Kattan’s Huda Beauty and Jeffree Starr’s personal account. Snapchat founder Evan Spiegel’s wife Miranda Kerr’s clean beauty label Kora Organics also posts frequently on Stories — one recent post linked to an upcoming Instagram livestream. Kora Organics also operates a Snapchat store, as do other beauty brands including ColourPop, KKW Beauty and Kylie Cosmetics. The platform does not take a selling fee and allows Snap Star accounts to open stores.

Il Makiage is using Snapchat ads to link to its online foundation-matching quiz that leads to a purchase page on its DTC site. Oran Holtzman, the co-founder and CEO of Il Makiage, said that the brand began to advertise on Snapchat a year ago, and has not significantly increased or decreased its Snapchat ad budget during the Covid-19 shutdown.

Ad position: web_incontent_pos1

“The beginning was tough and, at first, we didn’t see promising results,” he said of the brand’s initial foray onto Snapchat. “But due to its audience and as a strategic goal, we kept investing and learning the platform and its users.” He said that the brand studied the demands of Gen Z users, which it found “were incredibly skeptical of brands. We must demonstrate clear results in real time,” he said, because “younger generations don’t buy retouching.” The brand’s current ad for its foundations simply features influencers with skin issues applying the foundation to show how much coverage it provides. “Real consumers want to see someone like them,” said Holtzman.

“Six months ago, we started to see tremendous results, and today, Snapchat is one of our top social media avenues.”

Snapchat has settled into its niche in a social media landscape that includes competitors like Instagram and TikTok. The company had differentiated itself by marketing its closed, curated format as a safe space for advertisers. “We do not offer an open news feed where unvetted publishers or individuals have an opportunity to broadcast misinformation,” said a Snapchat spokesperson. Because the brand only allows content it approves onto Discover, brands do not have the brand safety issues they face on platforms that serve ads on user-generated content.

But advertising has slowed due to the pandemic. The company earned $462 million in revenue in the first quarter, for 44% year-over-year growth. Spiegel said in a statement, “We experienced high revenue growth rates in the first two months of the quarter, which offset our lower growth in March.”

But Snapchat’s future staying power may be found the loyalty of its Gen-Z user base. Snapchat claims that it is used by 90% of all 13 to 24 year olds. Some beauty brands’ advertising on the platform is targeted directly at young users, such as First Aid Beauty’s ad about its student loan forgiveness program.

Ad position: web_incontent_pos2

According to mobile insights and analytics platform App Annie, Snapchat users also tend to be loyal to the app. It found that in Q4 last year, 82% of Snapchat users did not use TikTok on any given day, while 44% did not use Instagram.