For Shiseido Group brands, “digital acceleration” has been a keyword during the pandemic. Overseeing this acceleration has been Shiseido Global CDO Angelica Munson, who entered the role in January to guide the company’s digital transformation (DX) in a world that had changed drastically over the past year. Munson spoke to Glossy about all things digital for the global portfolio as the company pursues a goal of 35% e-commerce penetration by 2023. In the first quarter of 2021, the group’s global e-commerce sales grew by 40%, with 6% overall sales growth compared to 2020 as all regions except Japan returned to growth.

The company’s digital focus has included a variety of new initiatives in the past year. In May, it established the Shiseido Interactive Beauty Company, Limited, a joint venture with Accenture to provide digital marketing and IT-related services to Shiseido Group brands. And in July, it was certified as a DX Business Operator by Japan’s Ministry of Economy, Trade and Industry.

“Technology continues to advance, and this rate of digitalization is only going to increase. We look at the future of growth; it’s going to require new skills, new operating models of how we work and collaborate internally and externally, and then the new tools and platforms,” Munson said.

On the shift to e-commerce

The group’s e-commerce strategy currently consists of three main pillars: DTC, retail partners and e-tailers such as Tmall and Lazada. Social commerce is considered to be a fourth “burgeoning area” for brands. For social commerce, labels in the portfolio such as Nars are experimenting with Instagram’s new drops feature, and many are tapping into shoppable video formats including livestreaming.

When it comes to its brands’ main sales channels, for “each of the regions, you have to calibrate it a little differently,” in terms of priorities, said Munson. “The U.S. has a very mature brand-owned experience,” while Chinese consumers are focused on e-tailers such as Tmall. Overall, sales channels are a “connected ecosystem,” she said.

DTC e-commerce as a “digital flagship”

The company thinks of its DTC sites as its “digital flagships.” During the pandemic, Shiseido Group brands have been especially focused on building out the customer service options that serve as alternatives to in-store testing and recommendations.

“We recreate and even elevate what we’ve been doing in-store,” said Munson, discussing how the company has worked on developing features that are generally “table stakes” in physical locations. These include site tools such as foundation finders, virtual try-on, skin-care questionnaires and virtual consultations, among others.

Ad position: web_incontent_pos1

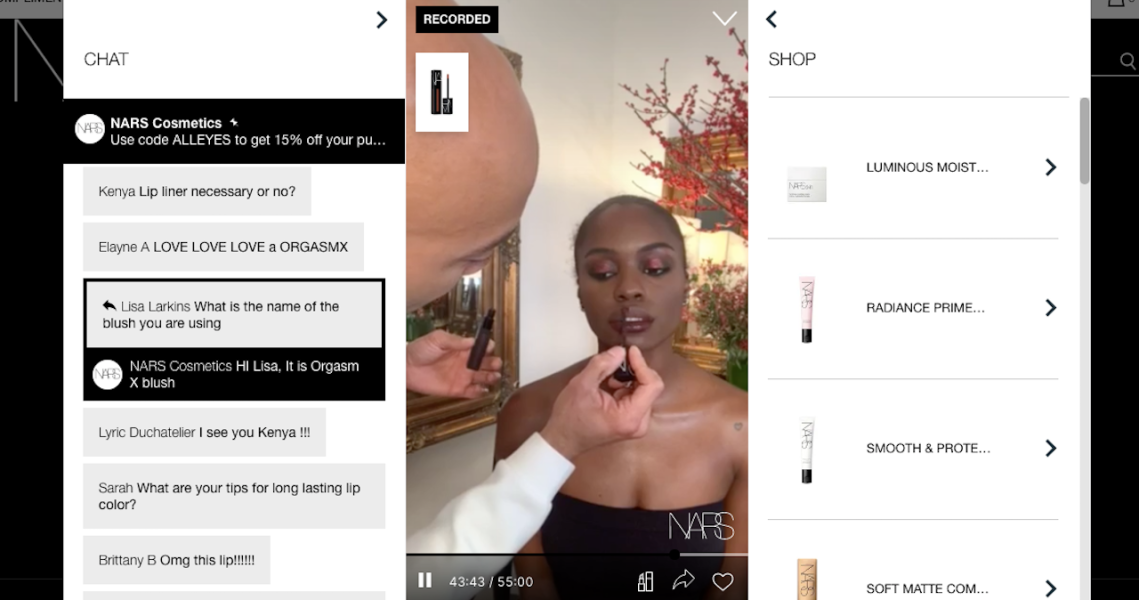

Livestreaming is a growing part of this on-site strategy, too. “The interesting thing about livestreaming is that it does tie very closely to video consultations: You can collect information; you can get people who have intent, and then when things start opening up again, you can use CRM to reach out to them,” said Munson.

Livestreaming across channels

All brands in the portfolio have deployed livestreaming in some fashion across the globe, including on DTC sites, retailer and e-tailer sites, and social channels such as Instagram and Facebook.

“Across all of our markets, everyone has played a role, but there are some more mature markets where they’re leveraging livestreaming as a key engagement channel,” said Munson. For DTC sites, the company works with the platform Bambuser. More than 10 Shiseido Group brands have hosted more than 85 livestreams across 10 markets including Japan, the U.S., Canada, the UK, Italy, Germany, Belgium and the Netherlands.

“People are really hungry for educational content,” she said of the drive for livestreaming, noting that makeup, skin care and fragrance have all seen strong demand. Recent livestream successes have included Hailey Bieber’s livestream event with BareMinerals, a Shiseido livestream with a makeup artist in Japan that had 6,000 views with 95% of viewers watching on mobile, and another recent event with celebrities Dream Ami and Serena Suzuki that had 15,000 viewers. They have been shown to drive sales; for example, a Canadian livestream with Narciso Rodriguez helped drive growth in the “triple digits,” she said.

Social commerce rising

But livestreaming is just one part of the company’s overall social commerce strategy. As Instagram morphs into a video platform and TikTok continues to attract prestige brands, the company has been experimenting with video formats both on its brand sites and social media.

Ad position: web_incontent_pos2

Demand for video content presented in “a succinct way” is growing, said Munson. Consumers “want advice; they want relevant content and they want it [to be] clear. It’s frictionless, and they’re so used to seeing snippets of content on Snapchat on TikTok.”

With livestreaming, specifically, content from the stream gets archived to the site and saved for other purposes. “Because video is such a liquid content medium, you can have a six-minute short film, and you can take that and cut it down to pre-rolls, and you can cut it down to sound bites that can be used in content and editorial, and also for video.”