As AI, AR and VR have interlaced beauty with technology, the Consumer Electronics Show or CES has become a destination for beauty companies to show off their latest tech advancements. However, does the beauty tech featured at the annual Las Vegas trade show actually make sense for the end customer?

Earlier this week at CES, Procter & Gamble debuted its updated Opte Precision Skincare System, a beauty tool that identifies hyperpigmentation and deposits serum onto areas of the skin. The device was a CES 2020 Innovation Award Honoree, and P&G expects the tool to be priced in the $600 range. For comparison, Foreo’s best-selling Luna 2 facial massager retails for $169, and NuFace’s and Ziip’s electrical devices are in the $400 bracket. Also this week, L’Oréal showcased its new beauty device, dubbed Perso, which brings the ability to personalize skin-care products, lipstick and foundation in the home. It is expected to launch in the first quarter of 2021 but has no set retail price at this time.

Though Procter & Gamble and L’Oréal’s devices are intended to come to market — Neutrogena’s 3D-printed sheet mask, MaskiD shown last year will launch for customers in the third quarter of 2020. However, there is a disconnect between what appears at CES, what actually gets produced by beauty companies and then what is able to be purchased by customers.

Still, beauty companies want to prove their technological prowess and be at the forefront of the next digital or technological shift that could affect their businesses — remember the iPhone?

“It’s surprising knowing the U.S. is trailing countries like China where skin care is also at the top of consumers’ priorities and the beauty device market is booming. The smart beauty craze in China is all about the same renewed attention consumers are paying to health and wellness in the U.S.,” said marketing consultant Benjamin Lord, who pointed to the historic success of beauty tech devices Alibaba’s Singles’ Day shopping festival.

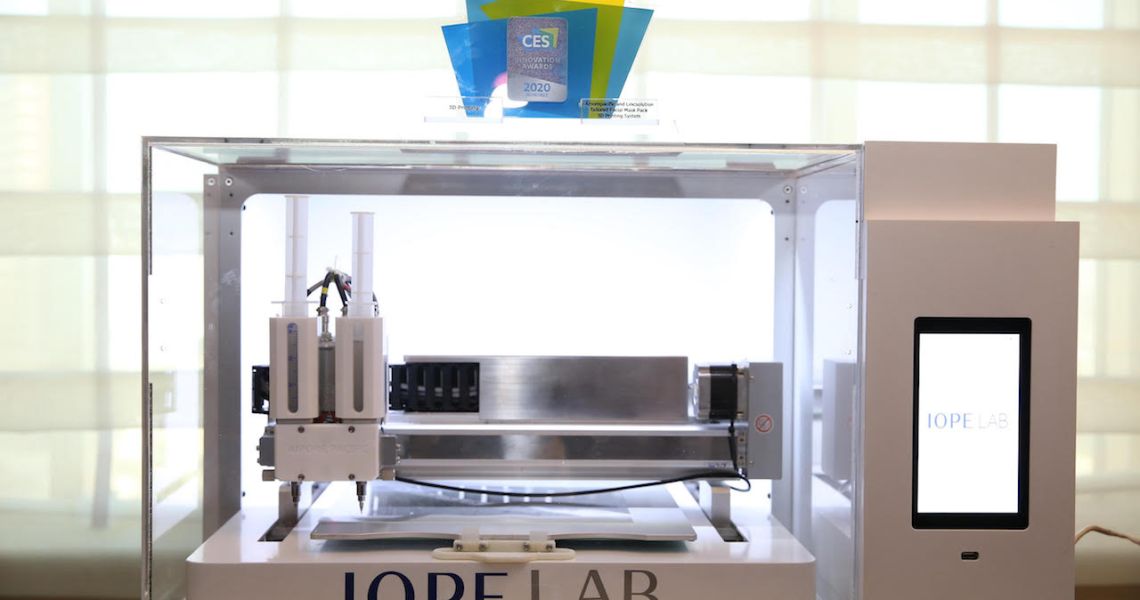

But that doesn’t mean beauty brands don’t see the value of testing and iterating on concepts that are shown at CES. Amorepacific is at the tech show this week, unveiling two innovations: a facial mask 3D printing system via its Iope brand that will be available for use at its Seoul flagship in March and a flexible LED device through its MakeOn brand. The MakeOn device will be available to purchase online, according to Dr. Jin Nam, director of the Futures Lab at Amorepacific R&D, but like L’Oréal’s Perso, no retail price has been set.

“Amorepacific has been producing face masks for years and helped turned masks into a core item of the Korean beauty trend. We realized existing products can’t fit various face contours and meet different skin concerns for each of the face areas, which made us see the value of personalized masks,” said Nam of the Iope 3D Mask.

Ad position: web_incontent_pos1

The idea is that consumers will be able to purchase specific masks for six parts of the face, like the forehead, chin or cheeks, and various needs such as anti-aging, dryness or acne. Because of its flexibility in use case, the Iope 3D Mask is able to satisfy all types of demographics from Gen Z to Boomers, said Nam. It also has the ability to produce 7,000 different types of masks in less than five minutes. (A previous version by Amorepacific saw the device produce one mask in 20 minutes.) Still, given the numerous need states and number of permutations, Nam said such a device needs the support of the beauty counter and sales associate, since it could be viewed as “complicated.” Amorepacific’s MakeOn LED device, meanwhile, is a bit easier for customers to incorporate into their routines since it is more simply an LED patch that connects to a headset.

In Amorepacific’s case, its new tools correspond to a larger trend: The global face masks market size is anticipated to see a compound annual growth rate of more than 10% to reach $11.4 billion by 2025, according to Adroit Market Research. But for the overall beauty device category, an overly hyper-futuristic positioning of beauty tools is inhibiting the faster adoption of devices by the average U.S. consumer — not to mention, the limited places to buy such tools.

“While words like ‘black tech’ and ‘radio frequency tools’ get techies aroused, they are scary to beauty consumers and not addressing the benefits of the product at all. What we see is usually not user-friendly, and design and packaging isn’t meeting beauty consumers’ criteria, either. They wonder, ‘How do I take it out of the packaging?’ ‘Does it fit in a gym bag?’ ‘Does it look good in my bathroom?” said Lord.

Swiss company Réduit is at least trying to solve for the ease of purchase issue for its spring consumer launch. Its Réduit One, a tech device that debuted at CES and promises more effective delivery of active ingredients onto hair sans excess product, is pursuing an omnichannel retail strategy by inking partnerships with to-be-determined high-end department stores, salons, and hair-care professionals, as well as selling the tool on its own DTC site.

“On a practical level, Réduit has the potential to drastically streamline consumers’ beauty routines,” said founder and CEO Paul Peros, who previously served as CEO of Foreo. “We are giving consumers the opportunity to do more with less. The majority of active ingredients in beauty products go to waste by drying, crystalizing or being wiped off without ever doing what they are designed to do.”