There’s a race underway to capture the more than $100 billion sitting in FSA and HSA accounts to be spent on products and services to improve one’s health.

Taking its cue from the wellness and fitness industries, which are successfully accessing these funds through dedicated e-commerce sites, retailer landing pages and new DTC payment processing plugins, the beauty industry is primed to ensure “skin health” is a growing part of the FSA and HSA marketplace.

Flexible spending accounts (FSAs) were introduced in 1978 to allow Americans to set aside pre-tax income to spend tax-free on medical, dental, vision and prescription expenses. Those include copays and exams, as well as over-the-counter medications like allergy and cold medicine.

Offered as a perk by employers, Money estimates around 40% of Americans have access to an FSA, with yearly contributions having exceeded $3 billion across more than 2.4 million accounts in 2021, as reported by Modern Retail. FSAs are employer-owned accounts, and while some offer rollover and a spending grace period, for the most part, FSAs are “use it or lose it” based on calendar year.

Health savings accounts (HSAs) were added in 2004 for those with a high-deductible insurance plan. HSA accounts are employee-owned, so balances roll over and can collect interest. According to Devenir Research, these accounts surpassed $100 billion in 2022.

The IRS, which oversees both programs, increased yearly contribution maximums in 2024 by $150 each, to $3,400 for FSAs and $4,150 for HSAs.

Originally, these allocations could be used to purchase a wide array of products and services, then things changed in 2010. “The ability to use FSAs and HSAs for over-the-counter products was first prohibited by the Affordable Care Act,” said Roberta Casper Watson, Esq, partner at Wagner Law Group in Tampa, Florida. “The CARES Act changed that back so that over-the-counter medications and menstrual products could be purchased with HSAs and FSAs.”

Ad position: web_incontent_pos1

The Coronavirus Aid, Relief and Economic Security Act, also known as the CARES Act, went into effect in 2020 and was designed to provide economic relief to Americans. It added hand sanitizer, face masks, thermometers and a list of other products back onto the eligibility list, including skin care that includes sunscreen or targets conditions like acne.

Shoppers save approximately 30% off MSRP when using FSAs and HSAs, thanks to saving on both income and sales tax. But even still, Americans lose $3 billion per year from expiring funds in FSAs, either by not spending it or not electing COBRA to extend their access after exiting a company, according to Money. This is just one part of the growing opportunity for skin care.

“Skin-care products are a perfect way to spend down your funds because, most likely, people are buying them anyway and now they can just buy them with tax-free health-care dollars,” said Susan Elliott-Bocassi, svp of operations at Health-E Commerce, which owns a group of stores that only sell items that are eligible for reimbursement with tax advantage health-care accounts. They include FSA Store, HSA Store and Well Deserved Health. Health-E Commerce was founded in 2010 and is privately held.

FSA Store sells personal care, OTC medicine and health tech, as well as skin-care products. Among them are vitamin C face serum from Oxy, pore-minimizing toner from Hero Cosmetics, exfoliating pads from PeterThomasRoth and lipstick with SPF from MDSolarSciences, among others. These products all feature ingredients that align with IRS Section 213(d), including benzoyl peroxide, salicylic acid and sunscreen with SPF 15 or higher. They’re viewed as “pre-approved” within the industry, so retailers are confident accepting FSA debit cards for payment or recommending a shopper request reimbursement from their FSA or HSA.

“We’re open to selling and to working with any brand partners who have high-quality skin-care products,” Elliott-Bocassi told Glossy. “As long as the products fit within the [IRS] 213(d) guidelines, we would consider them right now.”

Ad position: web_incontent_pos2

Currently, many retailers compete for these FSA/HSA dollars through dedicated landing pages that aggregate pre-approved items. They include Amazon, Walmart, Target DermStore and CVS, as well as DTC sites like Burt’s Bees, Supergoop, Murad, Obagi and Colorscience, among others,

In October, Sephora launched an FSA/HSA homepage with two categories: sunscreen and “skin-care solutions targeting acne and sensitive skin,” which includes light-therapy tools like red light.

“From the outset, the goal has been to help our clients make the most out of their FSA/HSA dollars by letting them know that they can use their FSA funds on eligible products and brands that they already know and love,” a representative from Sephora told Glossy via email.

As for brands that feel their products treat skin conditions with other ingredients and should be eligible? FSA Store’s Elliott-Bocassi said the best practice is for brands to seek pre-approval to be considered for its curation. “A brand partner would work with the IRS to understand if their product was eligible,” she told Glossy.

As is widely understood in the beauty industry, effective skin care goes beyond the limited array of currently pre-approved ingredients. Given the growing environment over the past few months, insiders say the IRS eligibility list’s expansion feels eminent.

“A brand could pay lobbyists to argue politically for items to be recognized as appropriate for such purchases,” said Watson, Esq. “The IRS might even start entertaining ruling requests.”

But first, the FSA/HSA marketplace is experimenting with the addition of telemedicine to expand eligible items. To wit: With a doctor’s note, FSA and HSA dollars can be spent on just about anything.

Earlier this month, FSA Store launched a collaboration with Apostrophe, a custom skin-care service that uses a remote dermatology team to prescribe skin care through video calls and photos. Apostrophe was acquired by Hims & Hers in 2021 for an undisclosed amount, as reported by Glossy. Shoppers can easily meet with a doctor by following links on FSA Store’s site and use their FSA/HSA dollars on any Apostrophe product deemed necessary for their skin’s health, from face cream to treatments and beyond.

Also using this strategy is an influx of new payment vendors that blend the approval process of telemedicine with the ease of pre-approved FSA/HSA shopping.

Adding a third-party plugin powered by telemedicine was the most alluring option for HigherDose, a wellness tech company known for its Sauna Blankets, when it began accepting FSA and HSA dollars at the end of October.

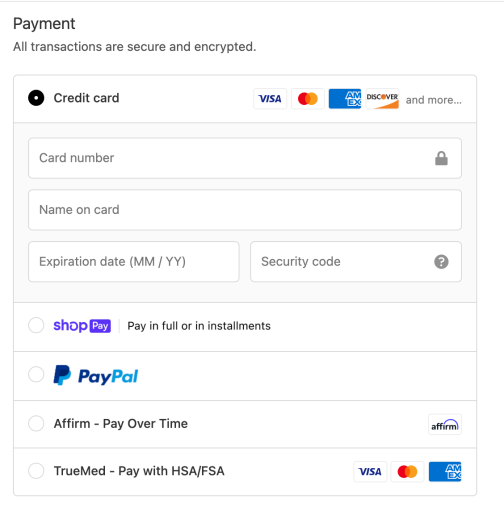

“It’s about accessibility,” Lauren Berlingeri, co-founder and co-CEO of Higher Dose told Glossy. “We explored a few other options, but TrueMed made the claim process seamless to our customers and they are also approved by Shopify as an FSA/HSA vendor.”

Calley Means, a former Washington D.C. food and pharmaceutical lobbyist and consultant, and his co-founder Justin Mares, a serial entrepreneur behind brands like Kettle & Fire and Perfect Keto, launched Truemed in 2023.

Similar to FSA Store’s partnership with Apostrophe, Truemed uses telemedicine to gain approval through a remote medical team. “We make an independent determination on each product,” Means said. After a brand and its assortment is approved by Truemed, its Shopify app can be installed and implemented in under an hour. Truemed averages an 8% commission, Calley told Glossy.

Since launching, Truemed has onboarded fitness studios like Orangetheory, Barry’s and Equinox; wearable tech companies like Whoop and Fourth Frontier; and meal delivery services like Daily Harvest, Sakara and ProLon. You can even use the Truemed app to pay your personal trainer using FSA/HSA funds. But Means says the next gold rush could be around skin.

“We are diving deep on skin care,” Calley told Glossy. “We have found that there is a universe of skin-care products with ingredients that are clinically proven to prevent specific conditions. … They aren’t automatically approved for HSA or FSA funding, but our physicians are comfortable approving it if it lines up with specific conditions people are trying to reverse or prevent.”

This includes products proven to reduce dry and irritated skin, as well as inflammation, which causes conditions like rosacea and eczema. It also includes products that strengthen the skin’s microbiome. Such treatments are rich with research within the beauty industry. Means and his team have been collecting said research and, in theory, it just needs to make its way to the IRS through the right channels to enable broad eligibility. Means told Glossy he’s sat own with more than 40 members of Congress to discuss the growing opportunity.

“Building a medically rigorous and compliant process is our existential priority,” Means told Glossy. “In the past several months, [Truemed has] issued over 50,000 letters of medical necessity, working closely with HSA and FSA providers. And they’ve been accepted [by the IRS].”

He’s confident a sea change is coming. “The body is connected and the skin is the largest organ in the body,” Means said. “We have some major announcements to come [in the skin-care market this year].”

A competing vendor, Sika Heath, launched in December and currently offers many skin-care brands like SLMD Skincare, Eczema Honey, Kinlò and Natural Skin Revival. Sika Health founder Dr. Ami Kumordzie, MD, raised $6.2 million in a round led by VC fund Forerunner Ventures, which has invested in Prose, Glossier and The Honest Company.

Truemed’s Means is careful to avoid the word “beauty” or “cosmetics” when discussing this growing opportunity. “There has to be some evidence toward the alleviation of some kind of condition,” Means said. “If the product is fully geared toward cosmetic purposes, we’re probably not going to approve it. But if the product has been shown to decrease inflammation or alleviate a specific skin condition, …”

He told Glossy that beauty brands are lining up to access FSA and HSA spending. “We have turned down hundred-million-dollar brands that don’t adhere to our standards,” Means said.

When it implemented Truemed in its Shopify checkout, HigherDose saw an immediate sales lift, Berlingeri said. “We’ve [also] seen faster expansion into new secondary markets and an uptick in inquiries regarding [FSA/HSA] eligibility,” she said. “We have seen positive feedback [that mentions] how this is a silver lining to an otherwise challenging health-care system in America.”