After years of hanging on the sidelines, it appears that clean makeup’s time has finally arrived.

On the heels of huge clean skin-care M&A deals of 2019, including the acquisitions of Drunk Elephant and Tatcha, clean color brand Lawless Beauty received a minority investment from Cult Capital right before the holidays. Though the terms of the deal were not disclosed, funds will be used to amplify product innovation (the brand is launching lipsticks in January and has plans for blushes and primers later in the year) and to hopefully hire a brand president. Presently, Lawless Beauty is exclusive with Sephora, and industry sources have said that the brand had previously been approached by conglomerates like L’Oréal and Shiseido.

Lawless Beauty is one of many clean makeup brands with ambitious plans for 2020. RMS Beauty will debut three clean makeup exclusives in Sephora stores in the first quarter of next year, as will Aether Beauty.

RMS Beauty founder Rose-Marie Swift said her products were made specifically with the Sephora customer in mind.

“Sephora has been an early adaptor of clean beauty and is very on board with this movement going into 2020,” said Swift. “We, as a pioneer in the clean color category, are so welcoming of this and are working with Sephora hand in hand. It is a wonderful way to develop SKUs that we know will be winners in-store, not only for the clean client but the performance-driven Sephora client as well.”

Lack of long-lasting wear and performance have historically given clean makeup brands a bad rap, but newer brands have proven to customers that they don’t have to give up the payoff of a Tom Ford or Nars lipstick when opting for better ingredients. To challenge the notion, Aether Beauty for its part is moving into lip cremes (a hybrid between a full color liquid lip and a lip gloss) and ethically sourced diamond highlighters. Abbitt is calling the latter a ‘clean Fenty’ alternative because of the products’ intense sparkle.

Not only have strategists noticed the uptick in clean makeup, but manufacturers have, too.

Ad position: web_incontent_pos1

“Clean makeup is no longer niche and no longer a trend. Ten years ago when I started Ilia, I was begging labs to explore creating formulas from scratch that were clean. Now the labs are bringing presentations of clean for us to review,” said Ilia Beauty founder Sasha Plavsic.

But for many of these clean makeup brands, more product isn’t necessarily the goal, especially when the color market has gone through an unpleasant softening throughout 2019.

Annie Lawless, founder and CEO of Lawless Beauty previously told Glossy, “The answer to the fatigue is, don’t give her stuff she doesn’t want or need, because she’s getting tired. Give her stuff that makes her excited and wakes her back up and gets her into your brand.”

The pressure for better-for-you and more curated product put forth by younger brands has made clean makeup stalwarts adjust their approach accordingly.

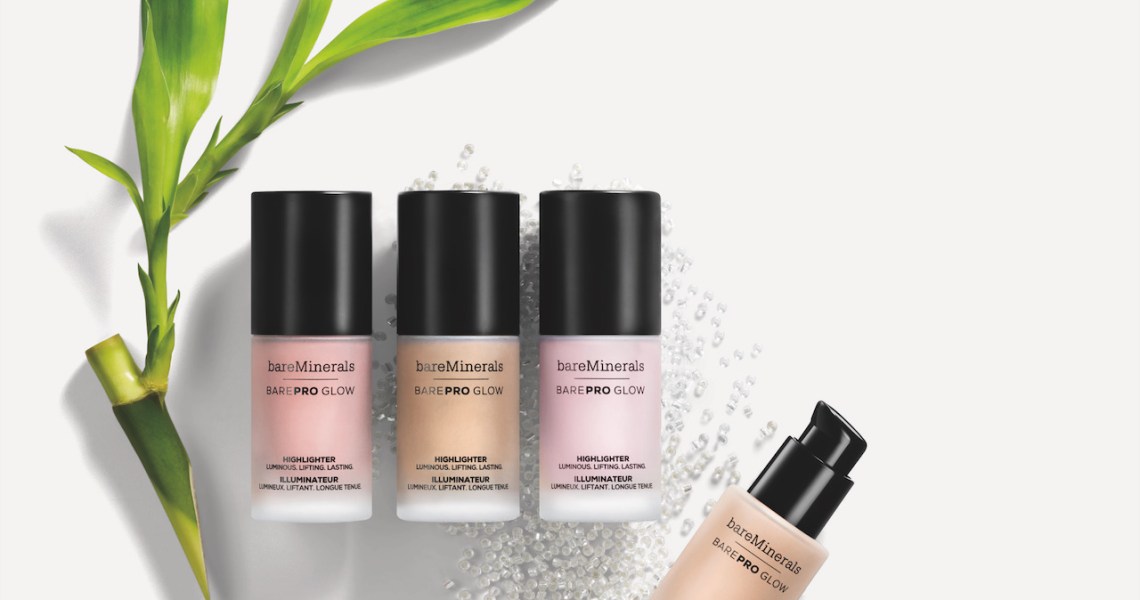

In January and February, BareMinerals will be launching its Skin Essentials Pureness and Mineralist Hydra-Smoothing Lipstick collections. Though the company has been a clean brand since its origin, for these launches, BareMinerals is clearly spelling out how many ingredients its products have and how they stack up to the competition. For example, tied to the Skin Essentials Pureness launch, BareMinerals is messaging in packaging and marketing the following statements: “Made with just 15 clean ingredients,” “60% fewer ingredients than top-selling moisturizers” and “40% fewer ingredients than top-selling cleansers.”

Ad position: web_incontent_pos2

Jill Scalamandre, president of BareMinerals, Buxom, and Global Development Shiseido Makeup, said this is something that the brand did 25-plus years ago but had abandoned.

“The brand did not focus on saying this to customers as much as we had in the past. Last year, we decided we need to go back to our original R&D story. Consumers don’t want to put the kitchen sink on their faces, so we are stressing less ingredients, more results,” said Scalamandre.

BareMinerals is sold in both of beauty’s biggest retailers, Ulta and Sephora. In Sephora, it does not have the Clean at Sephora distinction, but it’s messaged with the words “Clean without compromise.”

Scalamandre said that clean category has gotten so much bigger from even where it was when Drunk Elephant launched in 2013.

“When you look at clean brands like Drunk Elephant, which is now part of Shiseido Group, it’s clean clinical. Tiffany [Masterson] is using ingredients like Retinol and Vitamin C just like a dermatologist would,” she said. “For BareMinerals, clean is about using natural ingredients to get performance and long-lasting results. Customers want more options from their brands, so there is room for all of us to play.”