In 2025, gauging social media impact goes far beyond tracking a straightforward follower count or number of likes. With the introduction of its new proprietary metric known as the Total Social Impact metric, social media management platform Dash Social hopes to offer a more holistic view of a brand’s social reach, taking into account posts and engagement across social platforms like TikTok, Instagram, Pinterest and Facebook, formats like Stories and Reels, and origins of content like earned and owned posts.

“Social has just changed so much over the last 10 years, not only in how consumers use it from an intent and discovery perspective, but also, there are three times more channels, formats, metrics,” said Maggie Hickey, evp of marketing at Dash Social.

“What we were hearing from our customers was that there’s no way to be able to look at what you’re doing across social holistically in one number that has all the contacts,” she added. “It used to be followers. As we all know, followers are really dead at this point. It’s not really a key metric. Views don’t really matter if you’re not getting the engagement.”

Dash Social hopes the new metric will offer brands a way to gauge their social media performance against competitors. The company hopes it will offer an alternative to metrics like earned media value, which places a dollar value on social media mentions.

“We wanted it to be a score that’s a neutral number, and that is more like when you look at all the pieces that are driving your impact, your performance, your momentum and your relatability,” Hickey said.

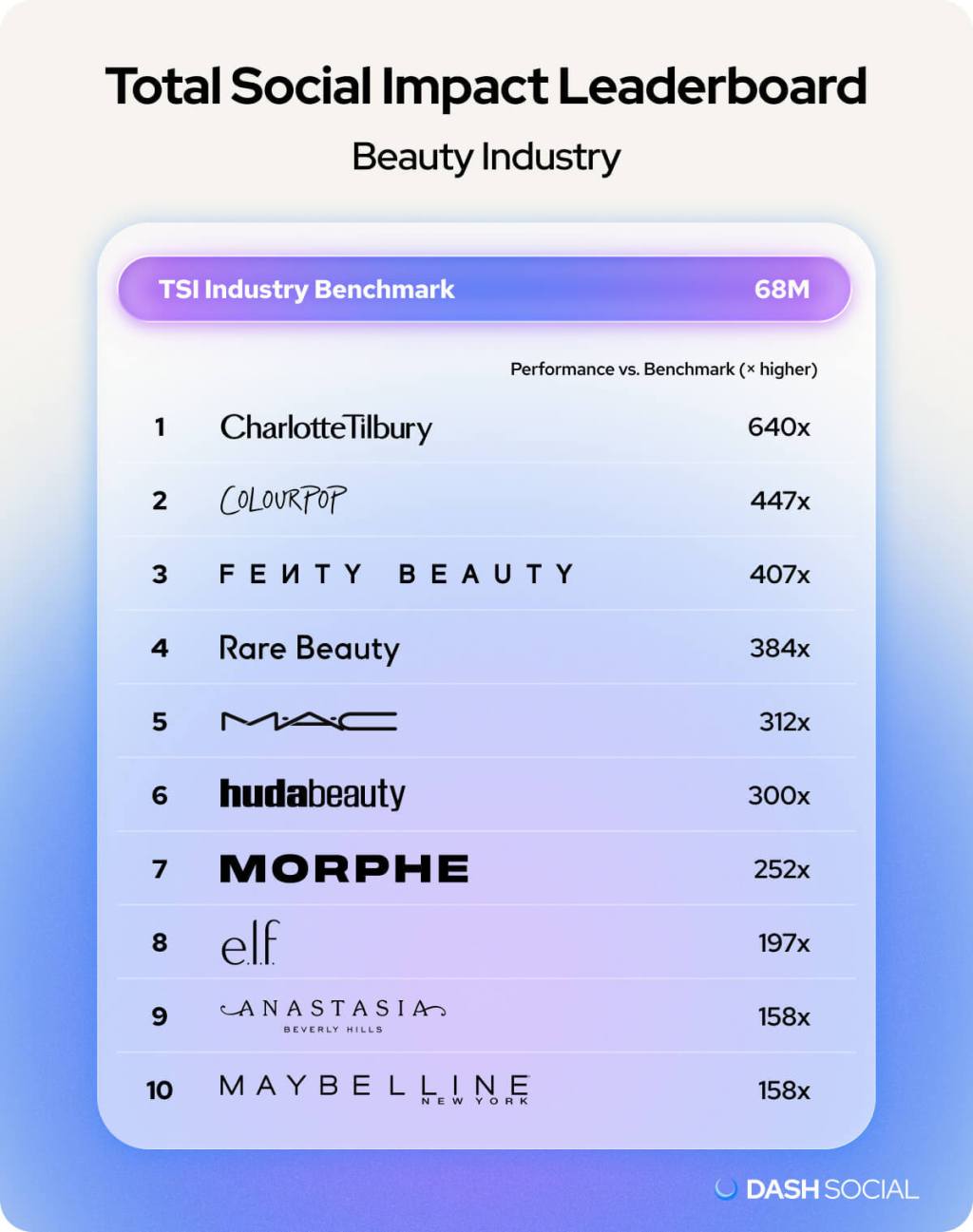

For the first release of its TSI leaderboard data, Charlotte Tilbury topped the beauty list with 640x the total social impact of the category benchmark. The Puig-owned makeup brand has welcomed partners like the Dallas Cowboy Cheerleaders and the Chinese music star Cai Xukun in recent months, in addition to expanding to Amazon in September. But Dash Social attributes much of the strength of the brand on social to Tilbury herself.

Ad position: web_incontent_pos1

“Charlotte Tilbury is the shining star [because] they are very much the OG creator brand. Before creators were a thing, Charlotte was a creator in and of herself, and she is at the front and center of everything they do,” said Jillian Robinson, director of global communications and events at Dash Social. “In building its social strategy around Charlotte — considering the fact that she is so involved, so engaged and so visible — the brand rcreates that kind of parasocial relationship between the community and the brand that other brands may struggle a bit more with.”

Rounding out the top five in the beauty list was ColourPop, Fenty Beauty, Rare Beauty and Mac. While Mac’s parent company, The Estée Lauder Companies, has struggled to regain sales in the color cosmetics division, the brand has lately leaned into ’90s nostalgia with the relaunch of discontinued shades like Cool Spice.

“[Mac] has actually had a huge year in social over the last 365 days, where they’ve looked to lean into their historic angle of being that artistry brand, to bring that to life on social,” said Robinson. “For them, right now, it’s less so about the product, and showing and telling that through a social lens, and more so about celebrating that artistry and leaning into culture.”

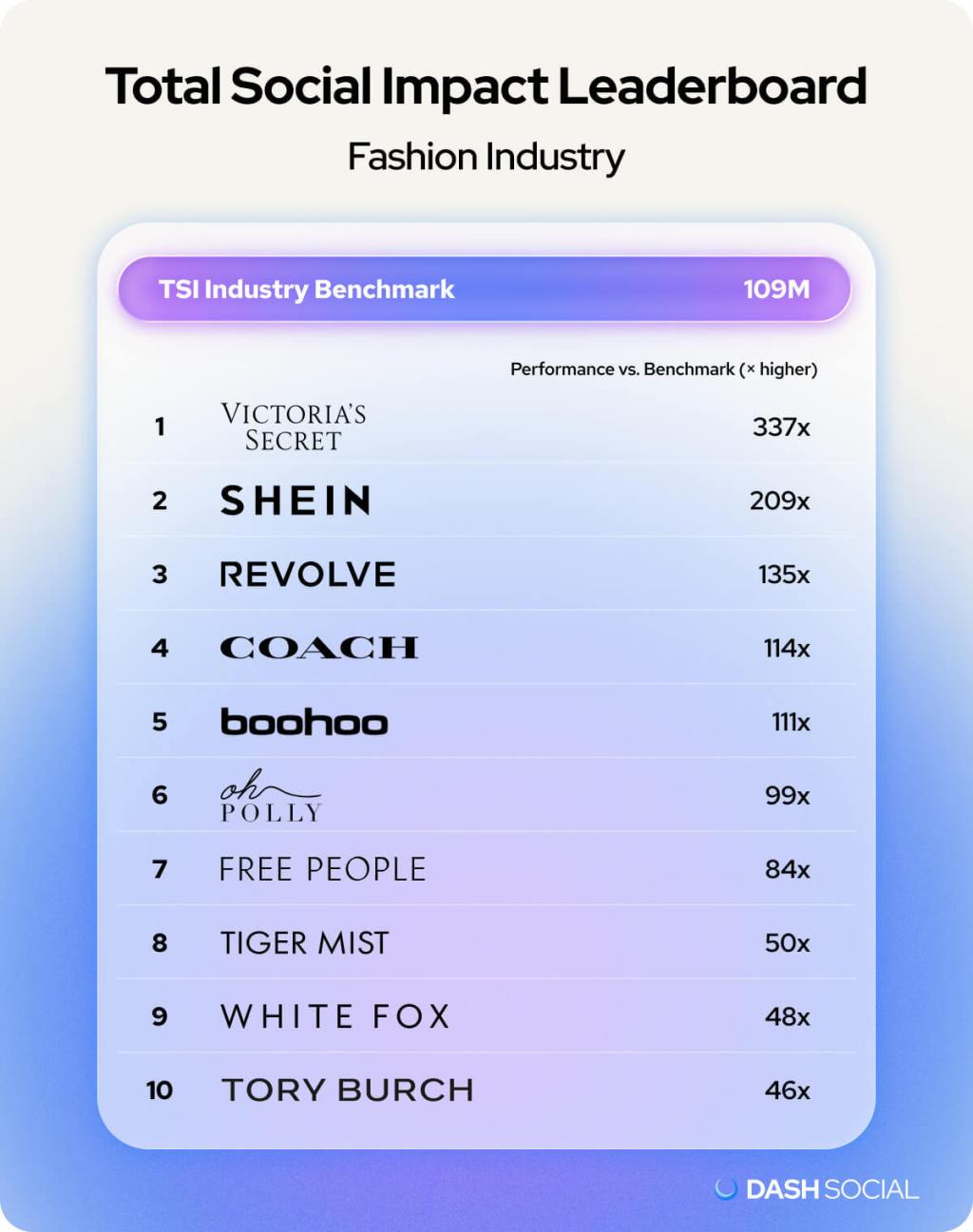

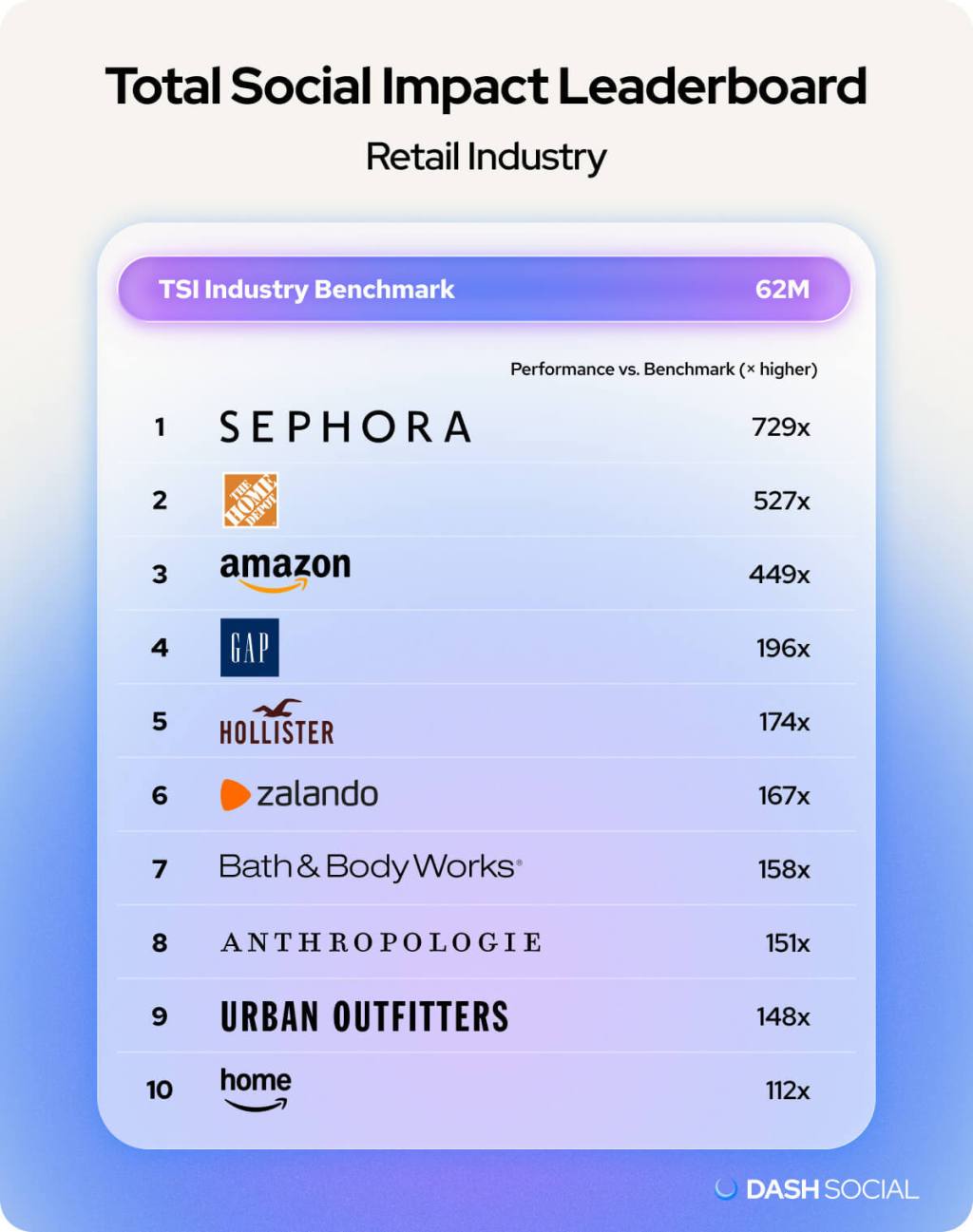

Dash Social also released leaderboards for fashion and retail brands. In fashion, Victoria’s Secret topped the rankings, with 337x the TSI of the category benchmark, followed by Shein, Revolve, Coach and Boohoo in the top five. In retail, Sephora dominated the category with 729x the benchmark, followed by The Home Depot, Amazon, Gap and Hollister.

While Dash cited beauty as a strong category in its TSI rankings, Ulta Beauty did not crack the top 10 in retail. Other fashion and beauty retailers to crack retail’s top 10 included Bath & Body Works, Anthropologie and Urban Outfitters.

Ad position: web_incontent_pos2

According to Dash Social, Sephora leads Ulta in a few key social metrics. From January 2025 to November 2025, Sephora accumulated 248,600 net new followers, compared to Ulta’s 176,300. Sephora also led on engagement, with 125 million combined likes and comments, compared to Ulta’s 1.2 million.

Despite generating one of the year’s biggest beauty stories with a sale to E.l.f. Beauty and anticipated arrival at Sephora, Hailey Bieber’s Rhode also did not make it into the top 10 in Dash’s TSI beauty leaderboard.

But with the social media landscape constantly evolving, that may soon change. Hickey said much of today’s social media value is also happening behind the scenes in private DMs and shares rather than just public-facing likes and comments.

“Social 10 years ago was traditional social media, where it was very personal to you and the people in your circle. Then we went through that social entertainment era, where it became much more about algorithms and that piece of it,” said Hickey. “But, with DMS and shares, we’ve seen this pocket of personal social come back up. And that’s why it’s really critical to be able to measure it and look at that in the context of the rest of your social — it’s such an engaged and specific audience.”