This week, we’re looking at what the future holds for livestream shopping in the U.S. following the news that Facebook is removing the feature.

Earlier this month, Meta announced in a blog post that Facebook will be shutting down its live shopping feature in October, “shifting our focus to Reels on Facebook and Instagram.” But over at Instagram, the state of livestream shopping is a different story. In mid-June, the platform hosted Hailey Bieber at its office for a shoppable livestream launching her new brand, Rhode Beauty, with products selling out throughout the event.

Livestream shopping has not become a social media mainstay in North America in the way short video has during the pandemic. Since the pandemic shutdowns hit in March 2020, social platforms have progressively been ramping up livestreaming and making the videos shoppable in hopes of emulating the feature’s success in China, where livestream shopping was worth $171 billion in 2020. But the growth of short video has been much more rapid. While some brands have scaled back on their livestreaming strategies in the U.S. market, others are still betting on it.

“We’re still very much leaned in on Instagram live shopping,” said Kristie Dash, head of beauty partnerships at Meta. Despite the Facebook shutdown of the feature, she said that “audiences are very different on Facebook and Instagram,” and “we see it really performing well” on Instagram. Beauty is especially important to Instagram livestream shopping, ranking among the top-three best-performing categories for the feature.

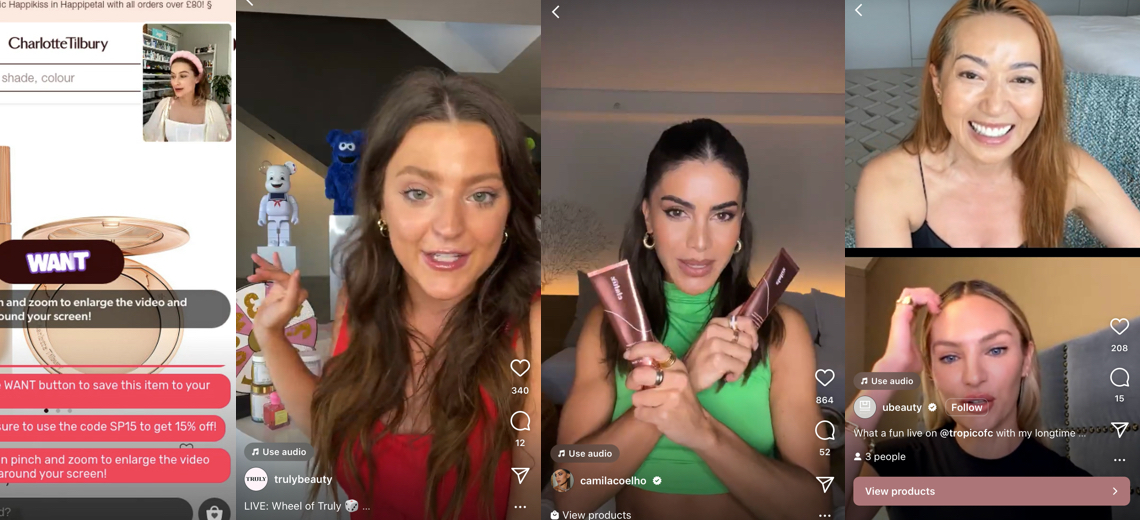

The platform is also emphasizing livestream shopping success case studies, especially for influencer-led brands. In one case study highlighted on its business site, Instagram showcases that a livestream hosted by Elaluz founder Camila Coelho celebrating a new bronzer launch was the source of 72% new buyers on Instagram for the month of October.

Instagram has “a younger, more excited discovery audience and Facebook [users] might want the tried-and-true brands they’ve seen at stores their whole lives,” said U Beauty founder Tina Craig, whose brand was one of the first ever to use the Instagram livestream shopping capability, along with Dragun Beauty. With a career background that includes introducing infomercials to the Asia market in the ’90s, Craig still regularly uses the feature and sees its potential in North America.

“It’s very strategic how [U Beauty] does livestreaming now,” said Craig, who said that the brand was hosting livestreams much more often earlier in the pandemic when people were at home. She said featuring Q&As answering viewers’ questions is effective for driving sales.

Ad position: web_incontent_pos1

“Livestreaming on Instagram is amazing. And I really hope that they don’t try to remove any sort of shopping live,” said Tyler Moore, social media manager at Truly Beauty. The brand is continuing to increase its investment in shoppable livestreaming on both Instagram and TikTok. It hosts a weekly game show, allowing viewers to take turns appearing on the live to play to win prizes.

“The revenue has been good enough to be able to do that and continue this strategy, so it’s not like we’re in there making $0 or failing, or not getting a lot of viewers,” said Moore, adding that Truly has seen the most success hosting livestreams on TikTok. In July, Financial Times reported that TikTok would be backing away from its livestream shopping initiatives in Europe and the U.S., which TikTok refuted.

While brands are increasingly allocating marketing budgets to TikTok, livestream shopping is “still an experimental budget,” said Ryan Detert, CEO of influencer marketing technology platform Influential.

TikTok has also been promoting its livestreaming feature in the U.S., commissioning a survey with results stating that “half of TikTok users have bought something after watching live.”

“Livestream commerce is gaining a lot of traction on TikTok. The platform’s algorithm, short-form video format and young audience make it ripe for success in livestream shopping,” said Rachael Samuels, senior manager of social media at market research firm Sprout Social. Sprout found that live video was the third most-engaging form of social content in 2022, following short video in the No. 1 slot.

Ad position: web_incontent_pos2

Instagram’s focus on Reels is apparent. The platform revealed that Reels is its fastest-growing content format by far, taking up 20% of the time people spend on Instagram, according to Meta’s Q1 2021 data. But Dash emphasized that Instagram is encouraging brands to use both Reels and livestreaming, focusing on Reels for brand discovery and livestreaming to engage with existing followers.

Beyond Facebook and Instagram, other social platforms are going in different directions, when it comes to livestream shopping. Earlier this month, livestream shopping platform Popshop Live laid off 18% of its staff. YouTube, on the other hand, has just begun to ramp up its emphasis on livestream shopping with features that were showcased in its recent Beauty Festival with brands including Glossier and Rhode.

One thing brands must do, say experts and founders, is learn how the market differs from China.

“It’s a whole different mentality” in China, said Craig. “Most of the population don’t live in a first- or even a second-tier city like Shanghai, Nanjing or Beijing. They’re in the third or fourth inner tiers, and they have expendable incomes, and they don’t have access” to high-end shopping experiences. “Through these livestreams from their WiFi, they’re able to reach the hottest influencers, celebrities and brands with a click,” she said.

Many experts argue that, in the U.S., livestream shopping should be used for specific events or product launches, rather than a 24-hours-a-day QVC-style format.

Dash said Instagram recommends brands use livestreaming for “high-heat drop moments.” According to her, “The [livestreams] that feel more like an event are the ones that are really resonating. They have that FOMO-inducing vibe to them.”

But for smaller brands with sales numbers in mind, “the return on ad spend is normally not there, on one-off [livestreams],” said Detert. Instead, brands with livestreams featuring “low production, but high desire and drops” that go live every week “have actually been seeing better returns,” he said.

Some brands are opting to pursue new formats of livestreaming that experts say are more suited to the North American market. Charlotte Tilbury, for example, has featured “shop with me” livestreams on its brand site using technology from livestreaming startup Buywith, which allows livestream hosts to click through product pages in real time while their own video appears in the corner.

“The potential [for livestreaming] is huge, since it’s still in its early stage,” said Adi Ronen, founder and CEO of Buywith, who argued that the “shop with me” model is better for the U.S. market. “You need to adjust the solutions to the U.S. culture, since it’s a different culture.” She said, for the U.S. market, the increased interactivity is a key component, creating an “experience of, ‘We’re all shopping together.’ It’s like a shopping party,” rather than “someone just trying to sell me some items.”

As for the future of livestreaming as part of her brand’s social shopping strategy, Craig said, “It’s definitely an important component, but I don’t see it as the end-all. The jury is really still out because American shopping behavior is a lot different than Chinese [behavior].”

Inside our coverage:

Olaplex’s CEO talks inflation.

How beauty brands are using TikTok for hiring.

Inside Vacation’s marketing strategy.

What we’re reading:

When it comes to celebrity endorsements, nepotism babies aren’t the ones getting the brand deals (because they don’t want them).

Some influencers have had it with promoting crypto.

A viral TikTok video alleges poisoning from a Shein nail product.