Alternative assets have become a growing area for those looking to combine their love for their favorite brands or products with a steady rate of growth. Classic assets like Hermès Birkins and Rolexes have long been popular investment buys. As sneaker prices go down, other alternative assets and also fractional ownership of styles like JLo’s Versace dress are set to catch on.

Gold and U.S. treasury yields have tumbled, caught in the uncertainty of the months to come. At the same time, fashion has learned from the flood of limited-edition sneakers that proved smart investments.

Gen Z is increasingly investing in Birkins and Rolexes, while fintech is expanding the possibilities of personal investment: Fractional ownership platform Luxus and UK savings platform Chip are turning to luxury archives to offer unique and valuable pieces for investment.

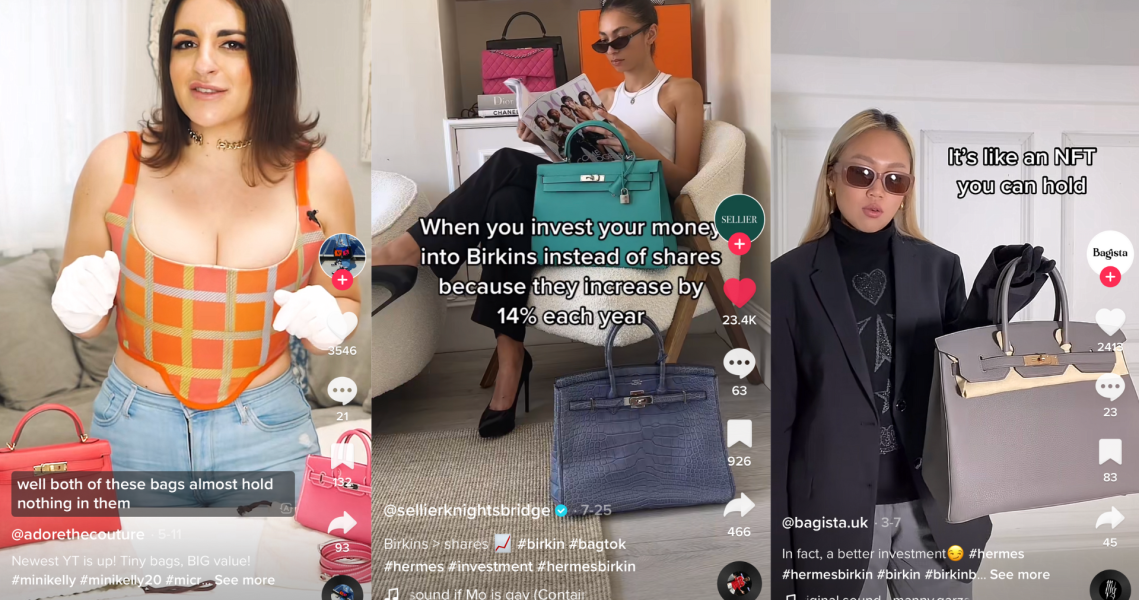

Hanuschka Toni is the founder of Sellier Knightsbridge, the UK’s biggest reseller of luxury superbrands, including Chanel, Hermès, Louis Vuitton and Christian Dior. With 25,000 followers on TikTok, the shop went viral for presenting bags like the Hermès Birkin as investments to Gen Z, spotlighting styles that appreciated in value by 14% a year, outperforming investment shares — a video earned 2.1 million views.

“Nothing right now is as liquid as a handbag. Part of our Tiktok and Instagram strategy is trying to convey the rarity of these pieces and the way they hold their value. In the long term, they’re better than any other asset class,” said Toni.

Birkins and Rolexes have traditionally been investments reserved for the ultra-wealthy, but with new companies offering fractional investment, the pool is starting to open. Previously, flipping sneakers was the popular way to turn fashion buys into investment plays, with sneaker marketplace StockX launching in 2015. However, the prices of popular sneakers have peaked. Now, customers are seeking out new fashion investments that could pay off, especially during a recession.

UK-based savings platform Chip opened up its alternative asset investment category in June, and it’s already seen mass interest. Its previous investment options focused on ISAs and stocks. So far, it has offered investments in a Ferrari Testarossa car and fine wines, all of which have sold out — the Ferrari, in 24 hours. But it is also eying the luxury fashion category. Its leaders are currently in talks with auction house Sotheby’s about proposing fractional ownership for an Hermès bag. Sotheby’s has been involved in fractional ownership with art and NFT’s, but not with luxury goods. At the moment, Chip’s main customers are men, but it hopes to bring in more women investors.

Ad position: web_incontent_pos1

“Luxury fashion items certainly have a role to kind of play in the [investment] space. Rare, exclusive, one-of-a-kind pieces and items which are highly desirable have retained their value over the last few years at a much higher rate than certain other investments,” said CEO Simon Rabin.

The difference now is that resellers and fintech platforms are offering fractional ownership to lower the barrier to entry into this level of investment. “We are trying to enable everyday savers and investors to get access to this asset class, which has historically been the way the 1% or high net worth [people] have invested,” said Rabin.

Luxus started offering fractional ownership in color diamonds and jewelry this year, and it’s set to do the same with watches in 2023. Co-founder and CEO Dana Auslander also plans to introduce iconic styles like JLo’s Versace dress and Kate Middleton’s Alexander McQueen dresses, as well as other looks from high fashion and pop culture. “Our model is to partner with luxury brands and really scour their archives, safes and vaults for incredible pieces,” she said. “Something worn by Jennifer Aniston to the Emmys or Kirstin Dunst in “Marie Antoinette,” or one of JLo’s Birkins that Hermès lent her in the 2000s would be huge conversation starters that would sell out quickly.”

However, Luxus is approaching the market carefully, focusing on long-term relationship building with luxury brands and one of a kind items as the most important characteristic to keep returns high. “Something that really is etched into the pop culture zeitgeist would do really well, probably at a 10-15% [return rate]. If it’s jewelry, it would be even better, at 20-40%,” Auslander said.